Growing Energy Needs

The increasing energy demands in India are driving the submarine power-cable market. As urbanization and industrialization accelerate, the need for reliable and efficient energy transmission becomes paramount. The government has set ambitious targets for renewable energy generation, aiming for 500 GW by 2030. This surge in energy production necessitates robust infrastructure, including submarine cables, to connect offshore wind and solar farms to the mainland grid. The submarine power-cable market is poised to benefit from these developments, as investments in infrastructure are expected to rise significantly, potentially reaching $20 billion by 2025. This growth reflects a broader trend towards sustainable energy solutions, which are essential for meeting the country's future energy requirements.

Rising Focus on Energy Security

The increasing emphasis on energy security is shaping the submarine power-cable market. As geopolitical tensions and climate change concerns rise, India is prioritizing the development of a resilient energy infrastructure. Submarine cables play a crucial role in diversifying energy sources and ensuring a stable supply. The submarine power-cable market is likely to see heightened activity as the government and private sector collaborate to enhance energy security through strategic investments in submarine cable projects. This focus on resilience is expected to drive market growth, with projections indicating a potential increase in market size by 30% over the next five years. Such developments reflect a broader commitment to sustainable and secure energy solutions.

Government Initiatives and Policies

Government initiatives aimed at enhancing energy security and promoting renewable energy sources are pivotal for the submarine power-cable market. Policies such as the National Offshore Wind Energy Policy and the National Electricity Policy encourage investments in offshore energy projects. These initiatives are designed to facilitate the development of submarine cable infrastructure, which is crucial for transmitting energy from remote offshore locations to urban centers. The submarine power-cable market is likely to see increased activity as the government allocates funds and resources to support these projects. With an estimated investment of $10 billion in offshore wind projects by 2025, the market is expected to expand, driven by favorable regulatory frameworks and financial incentives.

Increased Investment in Renewable Projects

The surge in investments in renewable energy projects is a significant driver for the submarine power-cable market. With a focus on reducing carbon emissions, India is witnessing a substantial influx of capital into offshore wind and solar energy projects. This trend is likely to create a robust demand for submarine cables, which are essential for connecting these renewable sources to the grid. The submarine power-cable market is expected to benefit from this investment boom, with estimates suggesting that the sector could attract over $15 billion in funding by 2025. This influx of capital will not only enhance infrastructure but also stimulate job creation and technological advancements within the industry.

Technological Innovations in Cable Manufacturing

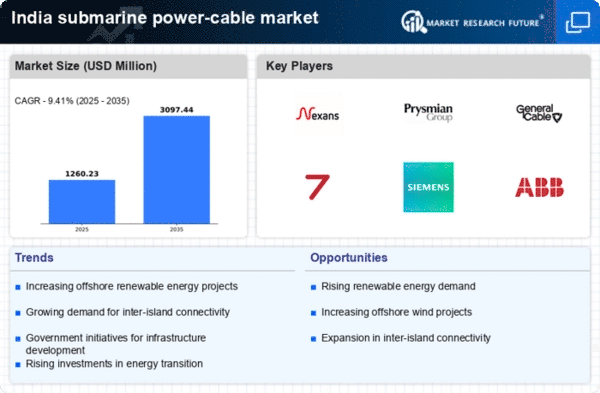

Technological advancements in cable manufacturing are transforming the submarine power-cable market. Innovations such as improved insulation materials and enhanced cable designs are increasing the efficiency and reliability of submarine cables. These advancements allow for longer cable lengths and higher voltage transmission, which are essential for connecting remote energy sources to the grid. The submarine power-cable market is witnessing a shift towards more durable and efficient products, which could potentially reduce installation and maintenance costs. As manufacturers invest in research and development, the market is expected to grow, with projections indicating a compound annual growth rate (CAGR) of 8% over the next five years. This growth is indicative of the industry's response to evolving energy demands.