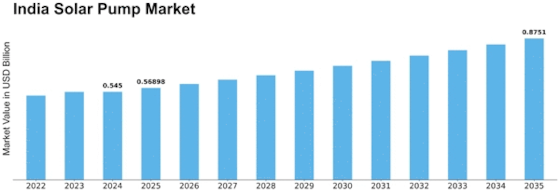

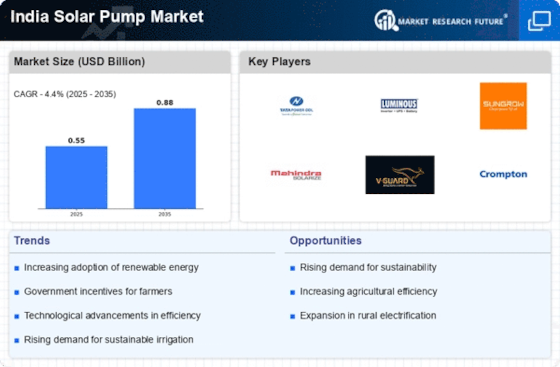

India Solar Pump Size

India Solar Pump Market Growth Projections and Opportunities

The India Solar Pump Market is currently witnessing significant trends that underscore the nation's commitment to sustainable and clean energy solutions. One prominent trend is the increasing adoption of solar pumps for agricultural irrigation. Farmers across India are recognizing the benefits of solar-powered irrigation systems, which offer a reliable and cost-effective alternative to traditional diesel or electric pumps. This trend aligns with the government's initiatives to promote solar energy in agriculture, providing farmers with access to clean and efficient irrigation solutions while reducing dependency on conventional energy sources.

Off-grid solar pumps are gaining traction as a notable trend in the India Solar Pump Market. These systems operate independently of the electricity grid, making them particularly well-suited for remote or rural areas where grid connectivity is limited. Off-grid solar pumps empower communities to harness solar energy for water pumping, addressing water scarcity challenges and promoting sustainable agriculture practices. This trend contributes to decentralized energy solutions and supports the electrification of remote regions.

The rise of innovative financing models is shaping the India Solar Pump Market. Recognizing the capital-intensive nature of solar pump installations, financial mechanisms such as pay-as-you-go models, leasing arrangements, and subsidy programs are becoming prevalent. These financial innovations aim to make solar pumps more accessible to farmers by alleviating the upfront cost burden. Government incentives and subsidies further incentivize the adoption of solar pumps, fostering a conducive environment for market growth.

Smart and connected solar pump solutions are emerging as a technological trend in the India Solar Pump Market. The integration of Internet of Things (IoT) devices, sensors, and data analytics enhances the performance and efficiency of solar pumps. Smart pumps enable remote monitoring, real-time data collection, and predictive maintenance, optimizing the overall system operation. This technological trend aligns with India's broader push towards digitalization and smart solutions in various sectors.

Government initiatives and policy support play a pivotal role in shaping trends within the India Solar Pump Market. The Pradhan Mantri Kisan Urja Suraksha evam Utthaan Mahabhiyan (PM-KUSUM) scheme, launched by the government, aims to promote solar pumps and solarization of agricultural feeders. Such policy measures, along with financial incentives, subsidies, and awareness programs, create an enabling environment for the widespread adoption of solar pumps across the country.

The integration of solar pump systems with energy storage solutions is becoming increasingly relevant in the India Solar Pump Market. Battery storage addresses the intermittent nature of solar power, enabling farmers to store excess energy generated during sunny days for use during periods of low sunlight. This trend enhances the reliability of solar pump systems, ensuring continuous water supply for agricultural activities, even in the absence of direct sunlight.

Entrepreneurial and community-driven solar pump initiatives are gaining prominence in the India Solar Pump Market. Non-governmental organizations (NGOs), local communities, and private enterprises are actively participating in deploying solar pump solutions, particularly in underserved regions. This trend reflects a bottom-up approach to addressing energy and water challenges, empowering communities and fostering sustainable development.

Technological advancements in solar pump design and manufacturing are influencing the market trends. Innovations in pump efficiency, durability, and ease of maintenance contribute to the overall performance of solar pump systems. This trend promotes the development of high-quality and reliable solar pumps, addressing the specific needs of Indian farmers and enhancing the overall competitiveness of the market.

Climate change resilience and water resource management are emerging as critical considerations influencing trends in the India Solar Pump Market. Solar pumps play a vital role in adapting to changing climate conditions by providing farmers with a sustainable and energy-efficient solution for irrigation. This trend aligns with the broader goal of achieving water security and promoting climate-resilient agricultural practices.

The India Solar Pump Market is characterized by dynamic trends that reflect the nation's commitment to leveraging solar energy for sustainable agricultural practices. The adoption of solar pumps for irrigation, the rise of off-grid solutions, innovative financing models, smart and connected technologies, government initiatives, energy storage integration, community-driven initiatives, technological advancements, and a focus on climate resilience collectively define the evolving landscape of the India Solar Pump Market. These trends position solar pumps as a key contributor to India's transition towards clean and decentralized energy solutions in the agricultural sector.

Leave a Comment