Rising Energy Costs

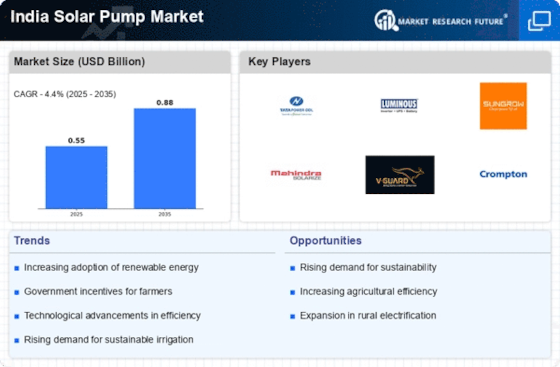

The rising costs of conventional energy sources, such as diesel and electricity, are prompting farmers to seek alternative solutions for irrigation. The india solar pump market is positioned to benefit from this trend, as solar pumps provide a cost-effective and sustainable alternative. With the increasing price volatility of fossil fuels, many farmers are turning to solar energy to mitigate their operational costs. Reports indicate that solar pumps can significantly reduce energy expenses, allowing farmers to allocate resources more efficiently. This economic incentive is likely to drive further adoption of solar pumps across various agricultural regions in India.

Government Initiatives

The Indian government has been actively promoting the adoption of solar pumps through various initiatives and schemes. Programs such as the Pradhan Mantri Kisan Urja Suraksha evam Utthaan Mahabhiyan (PM-KUSUM) aim to provide financial assistance to farmers for installing solar pumps. This initiative is expected to enhance the adoption rate of solar pumps in the agriculture sector, which is crucial for irrigation. As of January 2026, the government has allocated substantial funds to support this transition, indicating a strong commitment to the india solar pump market. The increasing number of beneficiaries under these schemes suggests a growing recognition of the benefits of solar energy in rural areas.

Sustainability Awareness

There is a growing awareness of sustainability and environmental conservation among Indian farmers, which is driving the demand for solar pumps. The india solar pump market benefits from this shift in mindset, as farmers increasingly recognize the importance of reducing their carbon footprint and reliance on fossil fuels. Solar pumps offer a clean and renewable energy source for irrigation, aligning with the global push towards sustainable agricultural practices. This trend is further supported by educational campaigns and workshops organized by various NGOs and government bodies, which aim to inform farmers about the long-term benefits of solar energy. Consequently, this heightened awareness is likely to contribute to the growth of the market.

Technological Advancements

The india solar pump market is witnessing rapid technological advancements that enhance the efficiency and affordability of solar pumps. Innovations in photovoltaic technology, such as the development of more efficient solar panels and energy storage systems, are making solar pumps more accessible to farmers. For instance, the introduction of smart solar pumps equipped with IoT technology allows for better monitoring and management of water resources. These advancements not only improve the performance of solar pumps but also reduce operational costs, making them a viable option for irrigation. As a result, the market is likely to expand as more farmers adopt these advanced solutions.

Government Subsidies and Financial Support

The availability of government subsidies and financial support mechanisms is a crucial driver for the india solar pump market. Various state and central government schemes provide financial assistance to farmers for the installation of solar pumps, making them more affordable. For instance, the subsidy rates can cover a significant portion of the installation costs, thereby encouraging farmers to invest in solar technology. As of January 2026, the government continues to enhance these financial support systems, which are instrumental in promoting the adoption of solar pumps. This financial backing not only alleviates the initial investment burden but also fosters a favorable environment for the growth of the solar pump market.