Rise of IoT and Connected Devices

The proliferation of Internet of Things (IoT) devices in India is significantly influencing the software defined-networking market. With millions of devices being connected to networks, the demand for scalable and flexible networking solutions is on the rise. Software defined networking offers the necessary infrastructure to manage the complexities associated with IoT deployments, enabling seamless connectivity and data flow. As per industry estimates, the number of connected devices in India is expected to reach 1 billion by 2025, further emphasizing the need for robust networking solutions. This trend is likely to drive investments in software defined networking technologies, as organizations seek to harness the potential of IoT while ensuring network reliability and performance.

Growing Demand for Network Agility

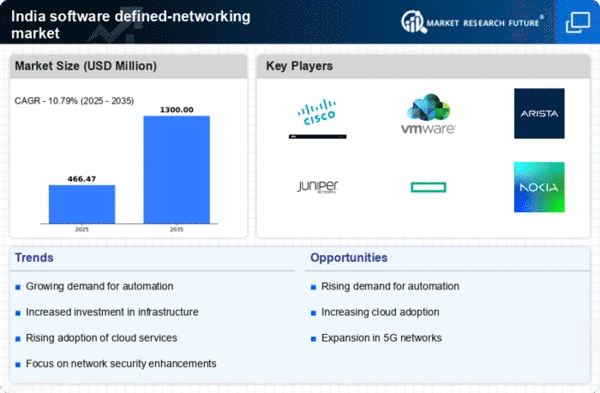

The software defined-networking market in India is witnessing a significant increase in demand for network agility. Organizations are increasingly seeking solutions that allow for rapid deployment and reconfiguration of network resources. This demand is driven by the need for businesses to adapt quickly to changing market conditions and customer requirements. According to recent data, the Indian market is projected to grow at a CAGR of 25% over the next five years, indicating a robust appetite for agile networking solutions. Companies are recognizing that traditional networking approaches may not suffice in a fast-paced digital landscape, thus propelling the adoption of software defined networking technologies. This shift is likely to enhance operational efficiency and reduce time-to-market for new services, making agility a critical driver in the software defined-networking market.

Regulatory Compliance and Data Privacy

In the context of increasing regulatory scrutiny, the software defined-networking market in India is being shaped by the need for compliance with data privacy laws. Organizations are compelled to adopt networking solutions that not only enhance security but also ensure adherence to regulations such as the Personal Data Protection Bill. This compliance requirement is driving the demand for software defined networking technologies that offer advanced security features and data management capabilities. Companies are recognizing that failure to comply with regulations can result in substantial penalties, thus motivating them to invest in solutions that mitigate risks. As the regulatory landscape evolves, the software defined-networking market is likely to expand, driven by the imperative of maintaining compliance and protecting sensitive data.

Cost Efficiency and Resource Optimization

Cost efficiency remains a pivotal driver in the software defined-networking market in India. Organizations are increasingly focused on optimizing their IT budgets while ensuring high-performance networking capabilities. By leveraging software defined networking solutions, companies can reduce hardware dependency and streamline network management processes. This transition is expected to lead to a reduction in operational costs by up to 30%, allowing businesses to allocate resources more effectively. Furthermore, the ability to automate network configurations and management tasks contributes to significant savings in labor costs. As Indian enterprises continue to prioritize cost-effective solutions, the software defined-networking market is likely to witness accelerated growth, driven by the promise of enhanced resource optimization.

Enhanced Network Performance and Reliability

The quest for enhanced network performance and reliability is a fundamental driver in the software defined-networking market in India. Organizations are increasingly aware that network downtime can lead to significant financial losses and damage to reputation. Software defined networking provides the tools necessary to monitor and optimize network performance in real-time, ensuring minimal disruptions. With the growing reliance on digital services, the demand for reliable networking solutions is intensifying. Recent studies indicate that businesses that implement software defined networking can achieve up to 99.9% network uptime, a compelling statistic that underscores the value of these technologies. As companies strive for operational excellence, the software defined-networking market is poised for growth, fueled by the need for dependable and high-performing networks.