Expansion of Cloud-Based Solutions

The shift towards cloud-based solutions is significantly influencing the servicenow store-apps market in India. As organizations increasingly adopt cloud technologies, the demand for applications that can operate seamlessly in cloud environments is on the rise. The Indian cloud computing market is expected to reach $10 billion by 2025, driven by the need for scalability, flexibility, and cost-effectiveness. This transition is prompting businesses to seek servicenow store-apps that can leverage cloud capabilities to enhance service delivery and operational efficiency. Furthermore, the ability to access applications remotely and integrate with other cloud services is becoming a critical factor for organizations. As a result, the servicenow store-apps market is likely to witness a surge in offerings that cater to the growing preference for cloud-based solutions.

Growing Emphasis on Compliance and Security

In the context of the servicenow store-apps market, compliance and security have emerged as pivotal concerns for organizations in India. With increasing regulatory requirements and the rising threat of cyberattacks, businesses are prioritizing solutions that ensure data protection and compliance with industry standards. The Indian cybersecurity market is projected to grow at a CAGR of 20% over the next few years, indicating a heightened focus on security measures. As organizations seek to mitigate risks, the demand for servicenow store-apps that offer robust security features and compliance management tools is likely to increase. This trend underscores the importance of integrating security into service management processes, thereby enhancing the overall resilience of organizations in the face of evolving threats.

Rising Demand for IT Service Management Solutions

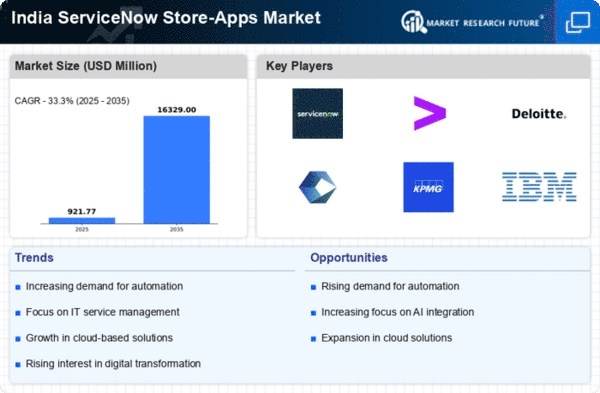

The servicenow store-apps market in India is experiencing a notable surge in demand for IT service management (ITSM) solutions. Organizations are increasingly recognizing the need for efficient IT operations to enhance productivity and reduce operational costs. According to recent data, the ITSM market in India is projected to grow at a CAGR of approximately 15% over the next five years. This growth is driven by the need for streamlined processes and improved service delivery. As businesses seek to optimize their IT infrastructure, the servicenow store-apps market is positioned to benefit from this trend, offering tailored applications that cater to specific organizational needs. The integration of advanced analytics and automation within these solutions further enhances their appeal, making them indispensable for companies aiming to stay competitive in a rapidly evolving digital landscape.

Increased Focus on Digital Transformation Initiatives

Digital transformation is a key driver for the servicenow store-apps market in India, as organizations strive to modernize their operations and enhance customer experiences. The Indian government has been promoting digital initiatives, which has led to a significant increase in investments in technology solutions. Reports indicate that the digital transformation market in India is expected to reach $100 billion by 2025. This shift is compelling businesses to adopt innovative solutions that can facilitate seamless integration and automation of processes. Consequently, the servicenow store-apps market is likely to see a rise in demand for applications that support digital workflows and enhance operational efficiency. As companies embark on their digital journeys, the need for robust service management solutions becomes paramount, positioning the servicenow store-apps market as a critical component of this transformation.

Increased Investment in Employee Training and Development

The servicenow store-apps market in India is also being shaped by a growing emphasis on employee training and development. Organizations are recognizing that investing in their workforce is essential for maximizing the benefits of technology solutions. As companies implement servicenow applications, the need for skilled personnel to manage and utilize these tools effectively becomes apparent. Reports suggest that organizations are increasing their training budgets by approximately 10% annually to ensure employees are equipped with the necessary skills. This trend not only enhances the effectiveness of servicenow store-apps but also contributes to higher employee satisfaction and retention rates. Consequently, the focus on training and development is likely to drive further adoption of servicenow solutions, as businesses seek to empower their teams to leverage technology for improved service management.