Growing Cyber Threat Landscape

The India security operations center market is experiencing a surge in demand due to the escalating cyber threat landscape. With the increasing frequency of cyberattacks, organizations are compelled to enhance their security measures. Reports indicate that India has witnessed a significant rise in cyber incidents, with a 300% increase in reported cases over the past few years. This alarming trend necessitates the establishment of robust security operations centers to monitor, detect, and respond to threats in real-time. As businesses across various sectors, including finance and healthcare, prioritize cybersecurity, the market for security operations centers is poised for substantial growth. The need for continuous monitoring and incident response capabilities is driving investments in this sector, thereby shaping the future of the India security operations center market.

Rising Awareness of Cybersecurity

The India security operations center market is witnessing a notable increase in awareness regarding cybersecurity among businesses and consumers alike. Organizations are beginning to recognize the potential financial and reputational damage that cyber incidents can inflict. This heightened awareness is prompting companies to invest in security operations centers to proactively manage and mitigate risks. According to recent surveys, over 70% of Indian enterprises now consider cybersecurity a top priority, leading to a surge in demand for specialized security services. As businesses strive to protect their assets and maintain customer trust, the establishment of security operations centers is becoming a strategic imperative. This growing consciousness about cybersecurity is likely to propel the India security operations center market forward.

Government Initiatives and Policies

The India security operations center market is significantly influenced by government initiatives aimed at bolstering national cybersecurity. The Indian government has launched various programs, such as the National Cyber Security Policy, which emphasizes the establishment of security operations centers across critical sectors. These initiatives are designed to enhance the country's cyber resilience and protect sensitive data from potential threats. Furthermore, the government's push for digital transformation in sectors like banking and e-commerce has led to increased investments in cybersecurity infrastructure. As a result, organizations are increasingly establishing security operations centers to comply with regulatory requirements and safeguard their digital assets. This trend is expected to drive the growth of the India security operations center market in the coming years.

Increased Investment from Private Sector

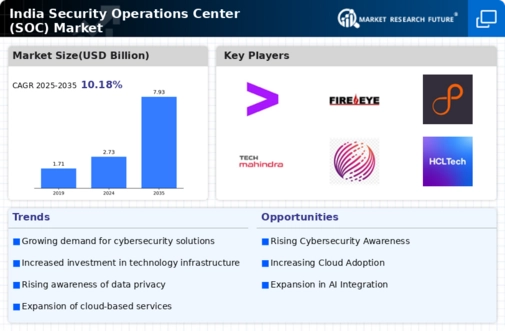

The India security operations center market is benefiting from increased investments from the private sector, as organizations recognize the critical need for robust cybersecurity measures. With the rise in cyber threats, companies are allocating substantial budgets to enhance their security infrastructure. Reports indicate that the cybersecurity market in India is expected to reach USD 13.6 billion by 2025, with a significant portion of this investment directed towards establishing security operations centers. This influx of capital is enabling organizations to adopt advanced technologies and hire skilled professionals, thereby strengthening their security posture. As private sector investments continue to grow, the India security operations center market is likely to expand, providing enhanced protection against evolving cyber threats.

Integration of Artificial Intelligence and Automation

The India security operations center market is increasingly integrating artificial intelligence (AI) and automation technologies to enhance operational efficiency. The adoption of AI-driven tools allows security operations centers to analyze vast amounts of data in real-time, enabling quicker threat detection and response. This technological advancement is particularly crucial in a landscape where cyber threats are becoming more sophisticated. Organizations are leveraging AI to automate routine tasks, thereby freeing up security personnel to focus on more complex issues. The market for AI in cybersecurity is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 20% in the coming years. This integration of advanced technologies is expected to redefine the capabilities of security operations centers in India, driving growth in the industry.