Advancements in Biotechnology

Technological advancements in biotechnology are propelling the RNA-based therapeutics market forward in India. Innovations in RNA delivery systems, such as lipid nanoparticles and viral vectors, enhance the efficacy of RNA therapies. These advancements facilitate the development of novel therapeutics that can target specific diseases more effectively. The Indian biotechnology sector has witnessed substantial growth, with investments reaching approximately $11 billion in 2025. This influx of capital is likely to foster collaboration between academic institutions and biotech firms, further driving research and development in RNA-based treatments. Consequently, the rna based-therapeutics market is expected to benefit from these technological breakthroughs, leading to a wider array of therapeutic options for patients.

Increasing Government Initiatives

Government initiatives aimed at promoting biotechnology and healthcare innovation are significantly impacting the RNA-based therapeutics market. The Indian government has launched various programs to support research and development in the life sciences sector, including the Biotechnology Industry Research Assistance Council (BIRAC). These initiatives provide funding and resources to startups and established companies working on RNA therapies. Furthermore, the government's focus on improving healthcare access and affordability is likely to create a conducive environment for the growth of the rna based-therapeutics market. With an expected increase in public and private partnerships, the market could see a surge in the development of RNA-based solutions, potentially reaching a market size of $2 billion by 2030.

Rising Demand for Targeted Therapies

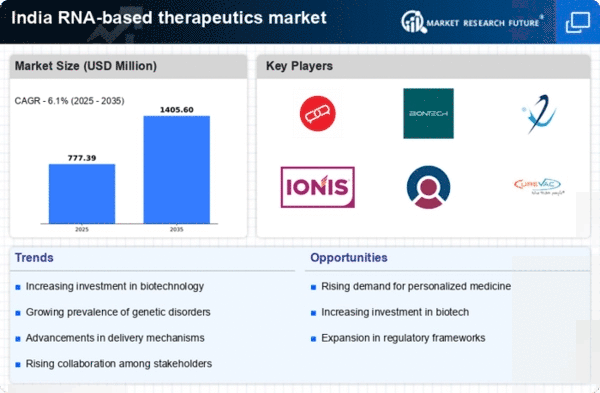

The shift towards personalized medicine is driving the demand for targeted therapies in the RNA-based therapeutics market. Patients and healthcare providers are increasingly seeking treatments that are tailored to individual genetic profiles. RNA-based therapies, which can be designed to target specific genetic mutations, align well with this trend. In India, the market for personalized medicine is projected to grow at a CAGR of 20% over the next five years. This growth is indicative of a broader acceptance of innovative treatment modalities that promise better efficacy and reduced side effects. As healthcare systems evolve, the rna based-therapeutics market is likely to expand in response to this rising demand for precision medicine.

Growing Prevalence of Genetic Disorders

The rising incidence of genetic disorders in India is a crucial driver for the RNA-based therapeutics market. With an estimated 6-8 million people affected by rare genetic diseases, the demand for innovative treatment options is increasing. RNA-based therapies offer targeted approaches to address these conditions, potentially improving patient outcomes. The Indian government has recognized the need for advanced healthcare solutions, leading to increased funding for research in this area. As a result, the rna based-therapeutics market is likely to expand, with a projected growth rate of around 15% annually over the next five years. This trend indicates a significant opportunity for companies specializing in RNA technology to develop effective treatments for genetic disorders.

Collaboration Between Academia and Industry

The collaboration between academic institutions and the biotechnology industry is fostering innovation in the RNA-based therapeutics market. Indian universities and research centers are increasingly partnering with biotech firms to advance RNA research and development. These collaborations often lead to the commercialization of novel therapies, bridging the gap between laboratory discoveries and clinical applications. With the Indian biotechnology sector projected to grow at a rate of 14% annually, such partnerships are essential for driving the rna based-therapeutics market forward. By leveraging academic expertise and industry resources, these collaborations may accelerate the development of RNA-based treatments, ultimately benefiting patients and healthcare providers alike.