Increased Focus on Sustainability

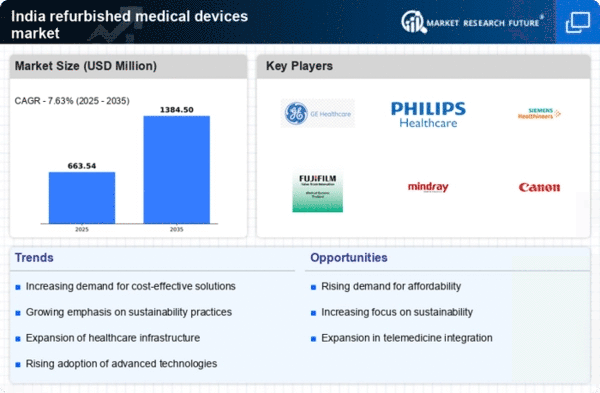

Sustainability has become a pivotal concern in the refurbished medical-devices market in India. As environmental awareness grows, healthcare institutions are increasingly prioritizing eco-friendly practices. Refurbished devices contribute to sustainability by reducing electronic waste and minimizing the carbon footprint associated with manufacturing new equipment. This shift aligns with India's broader environmental goals, as the government encourages practices that promote recycling and resource conservation. The refurbished medical-devices market not only supports these initiatives but also appeals to healthcare providers looking to enhance their corporate social responsibility profiles. By opting for refurbished equipment, hospitals can demonstrate their commitment to sustainable practices while also benefiting from significant cost savings. This dual advantage positions the refurbished medical-devices market as a key player in the evolving landscape of environmentally conscious healthcare.

Government Initiatives and Support

Government initiatives aimed at enhancing healthcare infrastructure are significantly impacting the refurbished medical-devices market in India. Policies promoting the use of refurbished equipment in public health facilities are gaining traction, as they align with the government's objectives to improve healthcare access and affordability. Programs that provide financial incentives for hospitals to purchase refurbished devices are also emerging, further stimulating market growth. The refurbished medical-devices market stands to benefit from these supportive measures, as they encourage healthcare providers to consider refurbished options as viable alternatives to new equipment. Additionally, the government's focus on strengthening healthcare systems in rural areas is likely to drive demand for affordable medical devices, thereby bolstering the refurbished market. This supportive environment may lead to an estimated market growth of 12% over the next few years.

Technological Integration and Innovation

The refurbished medical-devices market in India is witnessing a transformation driven by technological integration and innovation. Advances in refurbishment processes, such as improved testing and quality assurance protocols, have enhanced the reliability and performance of refurbished devices. This evolution is crucial as healthcare providers increasingly demand equipment that meets stringent operational standards. Moreover, the integration of digital technologies, such as telemedicine and remote monitoring, is creating new opportunities for refurbished devices to play a vital role in modern healthcare delivery. As hospitals and clinics adopt these technologies, the refurbished medical-devices market is likely to expand, catering to the growing need for compatible and reliable equipment. This trend suggests a promising future for the market, with potential growth rates reaching 20% annually as healthcare providers embrace innovative solutions.

Rising Demand for Affordable Healthcare Solutions

The refurbished medical-devices market in India is experiencing a notable surge in demand due to the increasing need for affordable healthcare solutions. As healthcare costs continue to rise, hospitals and clinics are seeking cost-effective alternatives to new medical equipment. This trend is particularly pronounced in rural and semi-urban areas, where budget constraints are more significant. The refurbished medical-devices market provides an opportunity for healthcare providers to acquire high-quality equipment at reduced prices, often up to 50% lower than new devices. This affordability is crucial for expanding access to essential medical services, thereby enhancing overall healthcare delivery in India. Furthermore, the market is projected to grow at a CAGR of approximately 15% over the next five years, indicating a robust shift towards refurbished solutions in the healthcare sector.

Growing Awareness and Acceptance Among Healthcare Providers

There is a growing awareness and acceptance of refurbished medical devices among healthcare providers in India. As the quality and reliability of refurbished equipment improve, more hospitals and clinics are recognizing the benefits of incorporating these devices into their operations. Educational initiatives and workshops aimed at informing healthcare professionals about the advantages of refurbished devices are contributing to this trend. The refurbished medical-devices market is increasingly seen as a viable option for maintaining high standards of patient care while managing costs effectively. This shift in perception is likely to drive market growth, as healthcare providers become more open to exploring refurbished solutions. With an anticipated increase in acceptance rates, the refurbished medical-devices market could see a growth trajectory of approximately 10% in the coming years, reflecting a significant change in the purchasing behavior of healthcare institutions.