Growing Geriatric Population

India's demographic shift towards an aging population is another critical driver influencing the radiology services market. By 2025, it is estimated that the elderly population will exceed 140 million, leading to an increased prevalence of age-related health issues. Older adults often require more diagnostic imaging services due to conditions such as osteoporosis, arthritis, and various cancers. This demographic trend suggests a heightened demand for radiological assessments, as healthcare systems strive to provide adequate care for this vulnerable group. The market is likely to adapt by enhancing its offerings, including mobile imaging services and tele-radiology, to meet the needs of the elderly. As a result, the market may experience substantial growth, with projections indicating a potential increase in service utilization by 15% in the coming years.

Rising Prevalence of Chronic Diseases

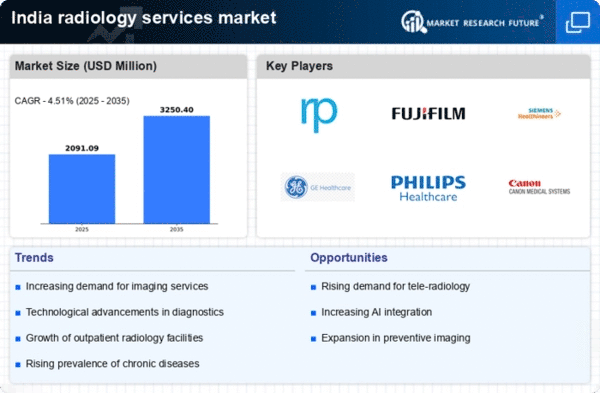

The increasing incidence of chronic diseases in India is a pivotal driver for the radiology services market. Conditions such as diabetes, cardiovascular diseases, and cancer are on the rise, necessitating advanced diagnostic imaging for effective management. According to recent health statistics, chronic diseases account for approximately 60% of all deaths in India, highlighting the urgent need for early detection and intervention. This trend is likely to propel the demand for radiological services, as healthcare providers seek to utilize imaging technologies to monitor and treat these conditions. The market is expected to expand significantly as hospitals and clinics invest in state-of-the-art imaging equipment to cater to this growing patient population. Consequently, the market is projected to witness a compound annual growth rate (CAGR) of around 10% over the next few years.

Technological Integration in Healthcare

The integration of advanced technologies in healthcare is transforming the market. Innovations such as artificial intelligence (AI), machine learning, and cloud-based imaging solutions are enhancing diagnostic accuracy and efficiency. AI algorithms can analyze imaging data more rapidly than traditional methods, potentially reducing the time required for diagnosis. Furthermore, cloud technology facilitates remote access to imaging studies, allowing for quicker consultations and second opinions. As hospitals and diagnostic centers in India increasingly adopt these technologies, the radiology services market is expected to expand. The market could see an increase in investment, with estimates suggesting that spending on radiology technology may reach $1 billion by 2027. This technological evolution not only improves patient outcomes but also streamlines operational processes within healthcare facilities.

Increased Health Awareness and Preventive Care

There is a notable rise in health awareness among the Indian population, which is driving the demand for preventive healthcare services, including radiology. As individuals become more informed about the importance of early detection of diseases, they are more likely to seek diagnostic imaging services. Campaigns promoting regular health check-ups and screenings are contributing to this trend, leading to an uptick in the utilization of radiological services. The market is likely to benefit from this shift towards preventive care, as healthcare providers expand their offerings to include comprehensive screening packages. This increased focus on preventive measures may result in a projected growth rate of 12% in the market over the next few years, as more individuals opt for routine imaging as part of their healthcare regimen.

Government Investment in Healthcare Infrastructure

The Indian government is making substantial investments in healthcare infrastructure, which is a significant driver for the market. Initiatives aimed at enhancing healthcare facilities, particularly in rural and underserved areas, are expected to improve access to diagnostic services. The government's commitment to increasing healthcare spending to 2.5% of GDP by 2025 indicates a strong focus on expanding medical services, including radiology. This investment is likely to lead to the establishment of new diagnostic centers and the upgrading of existing facilities with advanced imaging technologies. As a result, the radiology services market may experience accelerated growth, with projections suggesting an increase in service availability by 20% in the next five years, thereby improving overall healthcare outcomes.