Rise in Dental Tourism

The rise in dental tourism in India is emerging as a notable driver for the dental radiology-imaging-devices market. With India becoming a preferred destination for dental treatments due to cost-effectiveness and high-quality care, there is an increasing demand for advanced imaging technologies to cater to international patients. Dental clinics are investing in state-of-the-art radiology devices to enhance their service offerings and attract more patients. This influx of dental tourists is likely to stimulate market growth, as clinics seek to provide comprehensive diagnostic services that meet global standards. The dental radiology-imaging-devices market may experience a significant boost as a result of this trend.

Growing Geriatric Population

The demographic shift towards an aging population in India is a significant driver for the dental radiology-imaging-devices market. As the geriatric population increases, there is a corresponding rise in dental health issues, necessitating advanced diagnostic tools for effective treatment. Older adults often require more frequent dental visits, which in turn drives the demand for sophisticated imaging technologies. The market is likely to see a surge in the adoption of dental radiology devices that cater specifically to the needs of this demographic. This trend suggests a potential increase in market revenue as dental practices adapt to serve an aging clientele with complex dental health requirements.

Rising Oral Health Awareness

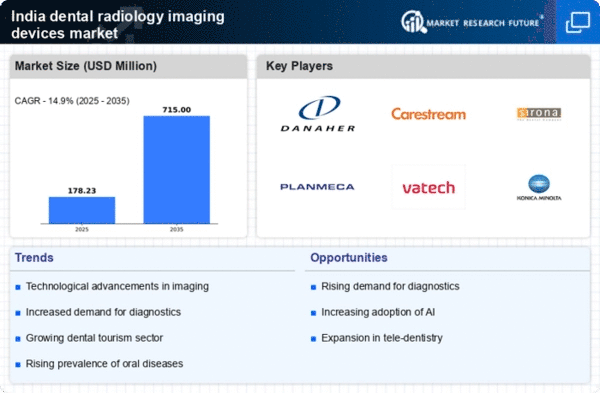

The increasing awareness regarding oral health among the Indian population is a pivotal driver for the dental radiology-imaging-devices market. As more individuals recognize the importance of regular dental check-ups and preventive care, the demand for advanced imaging technologies rises. This trend is reflected in the growing number of dental clinics and practices adopting state-of-the-art radiology devices. Reports indicate that the market for dental imaging devices in India is projected to grow at a CAGR of approximately 12% over the next few years. This heightened focus on oral health is likely to propel investments in innovative imaging solutions, thereby enhancing diagnostic accuracy and treatment planning in dental practices.

Technological Innovations in Imaging

Technological advancements in imaging modalities are significantly influencing the dental radiology-imaging-devices market. Innovations such as digital radiography, cone beam computed tomography (CBCT), and 3D imaging systems are becoming increasingly prevalent in dental practices across India. These technologies not only improve diagnostic capabilities but also reduce radiation exposure for patients. The integration of artificial intelligence in imaging analysis is also emerging, potentially streamlining workflows and enhancing diagnostic precision. As dental professionals seek to provide superior patient care, the adoption of these advanced imaging technologies is expected to rise, contributing to market growth. The market is anticipated to witness a substantial increase in the adoption of these innovative devices.

Government Initiatives for Dental Health

Government initiatives aimed at improving dental health infrastructure in India are likely to bolster the dental radiology-imaging-devices market. Programs promoting oral health education and preventive care are being implemented at various levels, encouraging the establishment of more dental clinics equipped with modern imaging technologies. Additionally, financial incentives and subsidies for healthcare providers investing in advanced radiology devices may further stimulate market growth. The government's focus on enhancing healthcare accessibility and quality is expected to create a conducive environment for the expansion of the dental radiology sector. This supportive framework could lead to increased procurement of imaging devices by dental practitioners.