Regulatory Changes and Compliance

The programmatic display-advertising market is influenced by ongoing regulatory changes and the need for compliance with data protection laws. In the UK, the implementation of stricter privacy regulations has prompted advertisers to adapt their strategies to ensure compliance. This shift is likely to drive investment in technologies that enhance data security and transparency. By 2025, it is expected that compliance-related expenditures will constitute a significant portion of the programmatic advertising budget. Advertisers are increasingly prioritizing consumer trust and data ethics, which may lead to a more sustainable advertising environment. Consequently, the programmatic display-advertising market is evolving to align with these regulatory demands, fostering a more responsible approach to digital advertising.

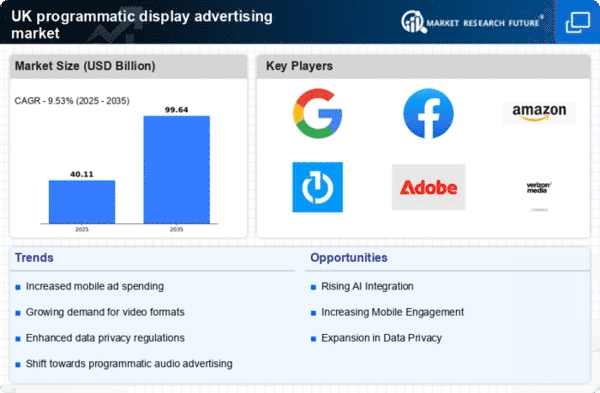

Growth of Digital Advertising Spend

The programmatic display-advertising market in the UK is experiencing a notable increase in digital advertising expenditure. In 2025, digital ad spending is projected to reach approximately £20 billion, with programmatic channels capturing a significant share. This growth is driven by brands shifting their budgets from traditional media to digital platforms, seeking more targeted and measurable advertising solutions. The ability to leverage data analytics and real-time bidding enhances the effectiveness of campaigns, making programmatic advertising an attractive option for marketers. As businesses increasingly recognize the value of digital presence, the programmatic display-advertising market is likely to expand further, reflecting the changing landscape of consumer engagement and advertising strategies.

Emergence of New Advertising Formats

The programmatic display-advertising market is witnessing the emergence of innovative advertising formats that enhance user engagement. As consumer preferences evolve, advertisers are exploring new ways to capture attention, such as interactive ads, video content, and augmented reality experiences. In 2025, it is projected that video ads will represent a substantial share of programmatic spending, driven by their ability to convey messages effectively. This diversification of ad formats allows brands to connect with audiences in more meaningful ways, potentially increasing conversion rates. As the programmatic display-advertising market adapts to these trends, it is likely to see a rise in creative advertising solutions that resonate with consumers, ultimately driving growth in the sector.

Advancements in Targeting Capabilities

The programmatic display-advertising market is benefiting from advancements in targeting technologies. Enhanced data collection methods and sophisticated algorithms allow advertisers to reach specific audiences with precision. In 2025, it is estimated that targeted advertising will account for over 70% of programmatic ad spend in the UK. This shift towards more personalized advertising experiences is crucial, as consumers increasingly expect relevant content. The ability to segment audiences based on demographics, interests, and online behavior enables brands to optimize their advertising efforts, leading to higher engagement rates and improved return on investment. Consequently, the programmatic display-advertising market is evolving to meet these demands, fostering a more effective advertising ecosystem.

Integration of Programmatic with Traditional Media

The integration of programmatic advertising with traditional media channels is emerging as a key driver for the programmatic display-advertising market. As advertisers seek cohesive marketing strategies, the blending of digital and traditional media allows for a more comprehensive approach to audience engagement. In 2025, it is anticipated that around 30% of traditional media budgets will be allocated to programmatic solutions, reflecting a growing recognition of the benefits of cross-channel campaigns. This integration facilitates better tracking and measurement of campaign performance, enabling brands to refine their strategies based on real-time data. As a result, the programmatic display-advertising market is likely to see increased collaboration between digital and traditional advertising sectors.