Advancements in Technology

Technological advancements play a pivotal role in shaping the Global Programmatic Display Advertising Market Industry. Innovations such as artificial intelligence and machine learning are enhancing the capabilities of programmatic platforms, allowing for more precise targeting and real-time bidding. These technologies enable advertisers to analyze vast amounts of data, optimizing ad placements and improving return on investment. As the industry evolves, the integration of advanced analytics tools is expected to drive growth, making programmatic advertising more attractive to brands seeking measurable results. This trend indicates a shift towards data-driven decision-making in advertising.

Growing Mobile Advertising

The rise of mobile device usage is significantly influencing the Global Programmatic Display Advertising Market Industry. With an increasing number of consumers accessing content via smartphones and tablets, advertisers are compelled to adapt their strategies to capture this audience. Mobile programmatic advertising is projected to expand rapidly, contributing to the overall market growth. As brands recognize the importance of mobile-first strategies, the demand for programmatic solutions tailored for mobile platforms is likely to surge. This trend suggests that the industry will continue to evolve, focusing on delivering seamless experiences across various devices.

Shift Towards Data Privacy

The Global Programmatic Display Advertising Market Industry is navigating a complex landscape shaped by evolving data privacy regulations. As consumers become more aware of their data rights, advertisers must adapt their strategies to comply with regulations such as GDPR and CCPA. This shift towards data privacy may initially pose challenges for programmatic advertising, but it also presents opportunities for innovation. Advertisers are likely to invest in privacy-centric solutions that maintain consumer trust while delivering effective advertising. This trend indicates a potential transformation in how data is utilized within the industry, fostering a more responsible approach to advertising.

Increasing Digital Ad Spend

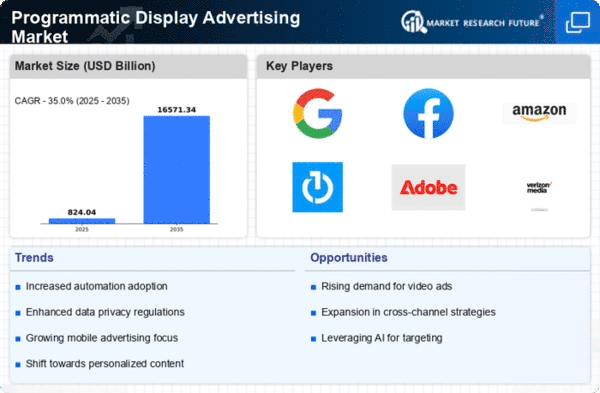

The Global Programmatic Display Advertising Market Industry is experiencing a notable increase in digital advertising expenditure. In 2024, the market is projected to reach 41.5 USD Billion, reflecting a growing preference for digital channels among advertisers. This shift is driven by the need for more targeted and efficient advertising solutions. As brands allocate larger portions of their budgets to programmatic advertising, the industry is likely to witness enhanced competition and innovation. The transition from traditional media to digital platforms underscores the importance of programmatic strategies in reaching diverse audiences effectively.

Emerging Markets and Global Expansion

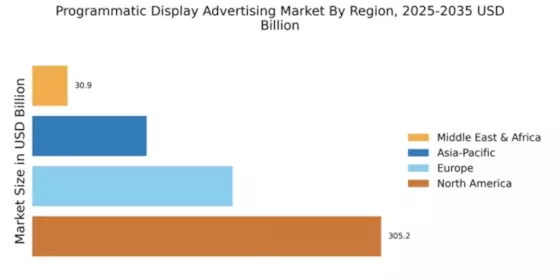

The Global Programmatic Display Advertising Market Industry is witnessing significant growth in emerging markets. As internet penetration increases in regions such as Asia-Pacific and Latin America, advertisers are exploring new opportunities to reach untapped audiences. This expansion is expected to contribute to the market's projected growth, with estimates suggesting a rise to 85 USD Billion by 2035. The compound annual growth rate (CAGR) of 6.72% from 2025 to 2035 indicates a robust future for programmatic advertising in these regions. As brands seek to establish a presence in diverse markets, programmatic solutions will play a crucial role in their strategies.