Expansion of Drone Technology

The rapid expansion of drone technology is a key driver for the photogrammetry software market. Drones equipped with high-resolution cameras are increasingly used for aerial surveys and mapping, providing a cost-effective and efficient means of data collection. In India, the drone market is projected to grow at a CAGR of 15.5% from 2021 to 2026, which may lead to a surge in demand for photogrammetry software that can process aerial imagery. This synergy between drones and photogrammetry software enhances the accuracy and speed of data acquisition, making it an attractive option for industries such as agriculture, mining, and real estate. As drone technology continues to evolve, the photogrammetry software market is likely to benefit from this trend.

Integration with Emerging Technologies

The integration of photogrammetry software with emerging technologies such as artificial intelligence (AI) and machine learning (ML) is transforming the landscape of the photogrammetry software market. These technologies enhance the capabilities of photogrammetry software by automating data processing and improving accuracy. For instance, AI algorithms can analyze vast datasets to generate high-quality 3D models more efficiently. In India, the AI market is expected to reach $7.8 billion by 2025, indicating a strong potential for synergy between AI and photogrammetry software. This integration not only streamlines workflows but also opens new avenues for innovation, making the photogrammetry software market more attractive to businesses seeking advanced solutions.

Rising Demand for 3D Mapping Solutions

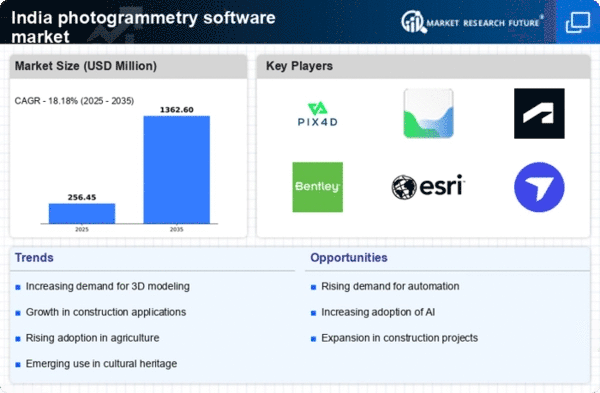

The increasing need for accurate 3D mapping solutions across various sectors is driving the growth of the photogrammetry software market. Industries such as construction, agriculture, and urban planning are increasingly relying on 3D models for project visualization and planning. In India, the construction sector alone is projected to grow at a CAGR of 7.1% from 2021 to 2026, which may lead to a heightened demand for photogrammetry software. This software enables professionals to create detailed topographical maps and models, enhancing decision-making processes. As the demand for precision in project execution rises, the photogrammetry software market is likely to experience significant growth, catering to the evolving needs of these industries.

Increased Focus on Infrastructure Development

The heightened focus on infrastructure development in India is driving the photogrammetry software market. The government has initiated several large-scale infrastructure projects, including highways, railways, and smart cities, which require precise planning and execution. Photogrammetry software provides essential tools for creating detailed models and simulations, facilitating better project management. With the Indian government's commitment to investing over $1.4 trillion in infrastructure by 2025, the demand for photogrammetry software is expected to rise. This investment not only supports economic growth but also emphasizes the importance of advanced technologies in infrastructure development, thereby propelling the photogrammetry software market forward.

Growing Interest in Geographic Information Systems (GIS)

The rising interest in Geographic Information Systems (GIS) is significantly impacting the photogrammetry software market. GIS technology is increasingly utilized for spatial analysis and data visualization, and photogrammetry plays a crucial role in providing accurate geospatial data. In India, the GIS market is anticipated to grow at a CAGR of 12.5% from 2021 to 2026, which may lead to increased adoption of photogrammetry software. This growth is driven by applications in urban planning, environmental monitoring, and disaster management. As organizations seek to leverage geospatial data for informed decision-making, the demand for photogrammetry software is likely to rise, further solidifying its position in the market.