Rising Demand for Efficiency

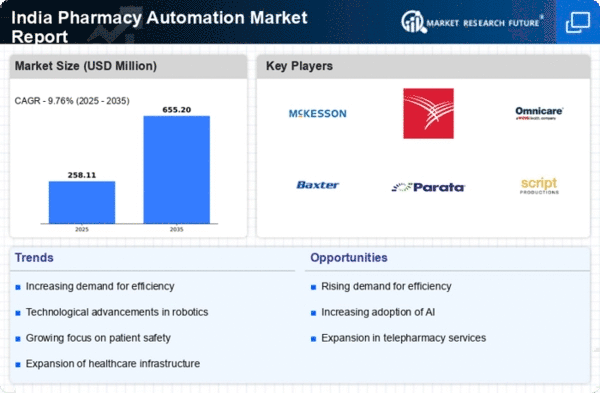

The pharmacy automation market in India is experiencing a notable surge. As healthcare providers strive to enhance operational workflows, automation technologies are increasingly being adopted. This shift is driven by the need to reduce human error and improve medication dispensing accuracy. According to recent data, the market is projected to grow at a CAGR of approximately 15% over the next five years. This growth is indicative of a broader trend where pharmacies are investing in automated systems to streamline processes, thereby enhancing overall productivity. The integration of automation not only optimizes inventory management but also allows pharmacists to focus more on patient care, which is becoming a critical aspect of the pharmacy automation market. Consequently, the emphasis on operational efficiency is likely to propel further advancements in automation technologies.

Growing Patient-Centric Services

The pharmacy automation market in India is increasingly aligning with patient-centric services. As healthcare evolves, pharmacies are recognizing the importance of providing personalized care to patients. Automation technologies facilitate this shift by enabling pharmacists to spend more time on patient interactions rather than administrative tasks. Automated systems can assist in managing patient records, medication therapy management, and adherence monitoring, which are essential for improving health outcomes. The emphasis on patient-centric services is likely to drive the adoption of automation solutions, as pharmacies seek to enhance their service offerings. This trend not only benefits patients but also positions pharmacies as integral components of the healthcare delivery system, thereby fostering growth in the pharmacy automation market.

Government Initiatives and Support

Government initiatives play a pivotal role in shaping the pharmacy automation market in India. Various policies aimed at improving healthcare infrastructure and promoting technological advancements are being implemented. For instance, the National Health Mission has been instrumental in encouraging the adoption of automation in pharmacies. Financial incentives and subsidies for technology integration are also being offered, which could potentially lower the barriers to entry for smaller pharmacies. This support from the government is expected to foster a conducive environment for the growth of the pharmacy automation market. Furthermore, as regulatory frameworks evolve, they may facilitate the integration of advanced technologies, thereby enhancing the overall efficiency and safety of pharmacy operations. The proactive stance of the government suggests a promising future for automation in the healthcare sector.

Increasing Focus on Inventory Management

Effective inventory management is becoming increasingly critical within the pharmacy automation market in India. With the rising complexity of medication management and the need to minimize waste, pharmacies are turning to automated solutions to optimize their inventory processes. Automated systems can provide real-time tracking of stock levels, expiration dates, and reorder points, which is essential for maintaining a balanced inventory. Reports indicate that pharmacies utilizing automation can reduce inventory costs by up to 20%. This focus on inventory management not only enhances operational efficiency but also ensures that patients receive their medications in a timely manner. As the demand for accurate and efficient inventory management grows, the pharmacy automation market is likely to expand, driven by the need for innovative solutions that address these challenges.

Technological Advancements in Automation

Technological advancements are significantly influencing the pharmacy automation market in India. Innovations such as artificial intelligence, machine learning, and advanced robotics are being integrated into pharmacy operations, enhancing the capabilities of automated systems. These technologies enable pharmacies to improve accuracy in medication dispensing and streamline workflows. For instance, AI-driven systems can analyze prescription patterns and optimize inventory levels, thereby reducing waste and improving service delivery. The market is witnessing a shift towards more sophisticated automation solutions that not only enhance efficiency but also improve patient outcomes. As these technologies continue to evolve, they are expected to drive further growth in the pharmacy automation market, making it imperative for pharmacies to stay abreast of these developments to remain competitive.