Rising Labor Costs

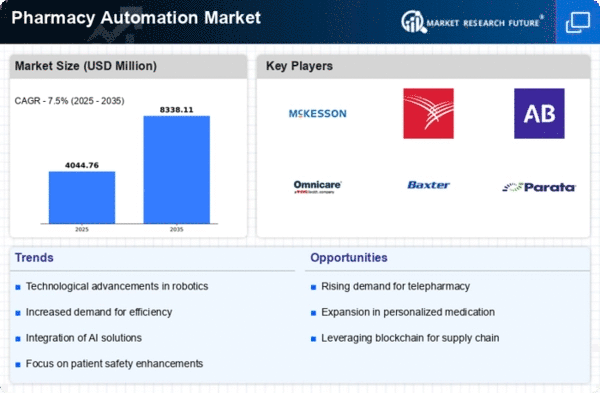

Labor costs in the pharmacy sector continue to escalate, prompting stakeholders to explore automation as a viable solution. The Global Pharmacy Automation Market Industry is increasingly influenced by the need to mitigate these rising costs while maintaining service quality. Automation technologies can alleviate the burden on pharmacy staff, allowing them to focus on patient care rather than repetitive tasks. This shift not only enhances operational efficiency but also contributes to cost savings. As a result, the market is anticipated to grow significantly, with projections indicating a value of 8.34 USD Billion by 2035, driven by the need to optimize labor resources.

Technological Advancements

Rapid advancements in technology are driving the evolution of the Global Pharmacy Automation Market Industry. Innovations such as artificial intelligence, machine learning, and advanced robotics are enhancing the capabilities of pharmacy automation systems. These technologies enable more sophisticated medication management, predictive analytics, and improved inventory control. As pharmacies increasingly adopt these advanced solutions, the market is poised for substantial growth. The integration of cutting-edge technology not only improves operational efficiency but also enhances patient outcomes, making automation an attractive option for pharmacies worldwide.

Increasing Demand for Efficiency

The Global Pharmacy Automation Market Industry experiences a notable surge in demand for efficiency within pharmacy operations. Automation technologies, such as robotic dispensing systems and automated medication management, streamline workflows, reduce human error, and enhance overall productivity. As pharmacies strive to optimize their operations, the market is projected to reach 3.76 USD Billion in 2024, reflecting a growing recognition of the benefits of automation. This trend is particularly evident in large healthcare systems where the integration of automated solutions has led to significant reductions in medication dispensing errors and improved patient safety outcomes.

Regulatory Compliance and Safety

The Global Pharmacy Automation Market Industry is significantly shaped by stringent regulatory requirements aimed at ensuring medication safety and compliance. Automation solutions assist pharmacies in adhering to these regulations by providing accurate tracking and documentation of medication dispensing processes. Automated systems can help mitigate risks associated with human error, thereby enhancing patient safety. As regulatory bodies continue to emphasize the importance of compliance, the adoption of pharmacy automation technologies is likely to increase. This trend is expected to contribute to a compound annual growth rate of 7.51% from 2025 to 2035, reflecting the growing importance of safety in pharmacy operations.

Aging Population and Chronic Diseases

The Global Pharmacy Automation Market Industry is influenced by the demographic shift towards an aging population and the rising prevalence of chronic diseases. As the demand for medication management increases, pharmacies are turning to automation to handle the complexities of medication dispensing and adherence. Automated systems can assist in managing prescriptions for chronic conditions, ensuring patients receive their medications on time. This trend is expected to drive market growth, as pharmacies seek to enhance their service offerings and improve patient care. The increasing need for efficient medication management solutions aligns with the projected growth of the market.