Rising Geriatric Population

The increasing geriatric population in India is a significant factor influencing the neuropathic pain market. As individuals age, they are more susceptible to various neuropathic conditions, including diabetic neuropathy and postherpetic neuralgia. According to recent statistics, the elderly population in India is projected to reach 300 million by 2050, which suggests a growing need for effective pain management solutions. This demographic shift is likely to drive the demand for neuropathic pain treatments, as older adults often experience chronic pain conditions that require specialized care. Consequently, the neuropathic pain market is expected to expand in response to the needs of this aging population.

Increased Incidence of Diabetes

The rising incidence of diabetes in India is a critical driver for the neuropathic pain market. Diabetic neuropathy is one of the most common complications associated with diabetes, affecting a significant portion of the diabetic population. Current estimates suggest that around 77 million people in India are living with diabetes, and this number is expected to rise. As the prevalence of diabetes increases, so does the incidence of neuropathic pain, which necessitates effective management strategies. This correlation between diabetes and neuropathic pain is likely to fuel the demand for targeted therapies, thereby contributing to the growth of the neuropathic pain market.

Improving Healthcare Infrastructure

The enhancement of healthcare infrastructure in India is a vital driver for the neuropathic pain market. With the government's focus on improving healthcare access and quality, more patients are likely to receive timely diagnosis and treatment for neuropathic conditions. Investments in healthcare facilities, telemedicine, and training for healthcare professionals are expected to facilitate better management of neuropathic pain. As healthcare accessibility improves, the number of patients seeking treatment is likely to increase, which could lead to a corresponding rise in the demand for neuropathic pain therapies. This trend indicates a positive outlook for the neuropathic pain market as it aligns with the broader goals of healthcare reform in India.

Advancements in Pharmaceutical Research

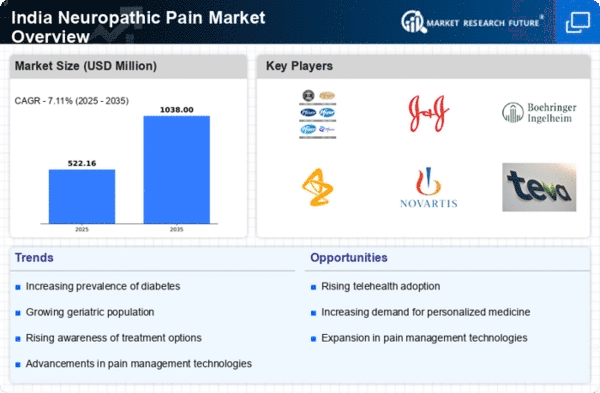

Innovations in pharmaceutical research are playing a pivotal role in shaping the neuropathic pain market. The development of new analgesics and adjuvant medications, such as anticonvulsants and antidepressants, is providing healthcare providers with a broader range of treatment options. Recent studies indicate that novel compounds are being explored, which may offer improved efficacy and safety profiles. In India, the market for neuropathic pain medications is projected to grow at a CAGR of approximately 8% over the next five years, driven by these advancements. As research continues to evolve, the availability of more effective therapies is likely to enhance patient care and satisfaction within the neuropathic pain market.

Increasing Awareness of Neuropathic Pain

The growing awareness of neuropathic pain among healthcare professionals and patients is a crucial driver for the neuropathic pain market. Educational initiatives and campaigns are being implemented to inform the public about the symptoms and treatment options available. This heightened awareness is likely to lead to earlier diagnosis and treatment, which could enhance patient outcomes. In India, the prevalence of neuropathic pain is estimated to affect approximately 7-8% of the population, indicating a substantial market potential. As more individuals recognize their symptoms and seek medical advice, the demand for effective therapies is expected to rise, thereby propelling the neuropathic pain market forward.