Government Initiatives and Funding

Government initiatives aimed at improving pain management services are significantly influencing the neuropathic pain market. The UK government has recognized the need for enhanced support for individuals suffering from chronic pain, leading to increased funding for research and development in this area. Initiatives such as the National Institute for Health Research (NIHR) are actively promoting studies focused on neuropathic pain, which may result in the discovery of new treatment modalities. Additionally, public health campaigns aimed at raising awareness about neuropathic pain are likely to encourage more patients to seek help. This proactive approach by the government not only fosters innovation but also enhances accessibility to effective treatments, thereby driving growth in the neuropathic pain market.

Increased Focus on Patient-Centric Care

The growing emphasis on patient-centric care is influencing the UK neuropathic pain market. Healthcare providers are increasingly recognizing the importance of tailoring treatment plans to individual patient needs, preferences, and experiences. This approach encourages shared decision-making between patients and clinicians, leading to more effective pain management strategies. The rise of digital health technologies, such as telemedicine and mobile health applications, facilitates this patient-centric model by providing patients with greater access to information and support. As the healthcare landscape evolves, the neuropathic pain market is likely to adapt to these changes, with a focus on delivering personalized care that enhances patient satisfaction and outcomes.

Advancements in Pain Management Therapies

Innovations in pain management therapies are transforming the landscape of the neuropathic pain market. Recent developments in pharmacological treatments, including novel analgesics and adjuvant medications, have shown promise in alleviating neuropathic pain symptoms. For instance, the introduction of medications such as gabapentinoids and SNRIs has provided new avenues for treatment. Furthermore, the integration of non-pharmacological approaches, such as transcutaneous electrical nerve stimulation (TENS) and cognitive-behavioral therapy, is gaining traction. The UK healthcare system is increasingly adopting these advanced therapies. This may lead to improved patient outcomes and satisfaction. As a result, the neuropathic pain market is likely to witness a surge in demand for these innovative treatment options, reflecting a shift towards more comprehensive pain management strategies.

Growing Demand for Non-Opioid Pain Relief

The shift towards non-opioid pain relief options is reshaping the neuropathic pain market. With increasing concerns regarding opioid dependency and side effects, healthcare providers are exploring alternative therapies. Non-opioid medications, including anticonvulsants and topical agents, are gaining popularity as safer options for managing neuropathic pain. This trend is particularly relevant in the UK, where regulatory bodies are advocating for responsible prescribing practices. As patients and clinicians alike seek effective yet safer pain management solutions, the demand for non-opioid therapies is expected to rise. This shift not only reflects changing attitudes towards pain management but also presents opportunities for pharmaceutical companies to develop and market innovative non-opioid products within the neuropathic pain market.

Rising Incidence of Neuropathic Disorders

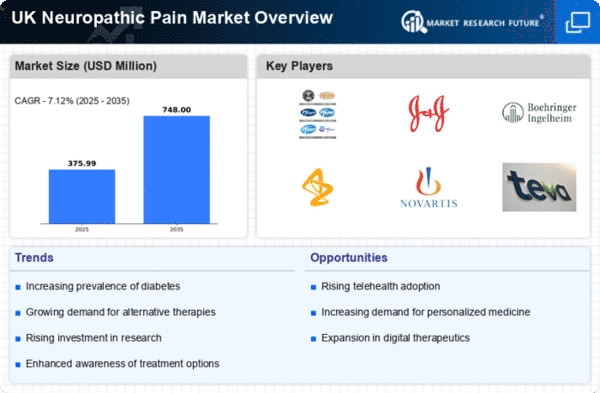

The increasing prevalence of neuropathic disorders in the UK is a primary driver for the neuropathic pain market. Conditions such as diabetic neuropathy and postherpetic neuralgia are becoming more common, with estimates suggesting that around 8% of the population may experience neuropathic pain at some point in their lives. This rise in incidence is likely linked to factors such as an aging population and the growing rates of diabetes. As more individuals seek effective pain management solutions, the demand for treatments within the neuropathic pain market is expected to grow significantly. This trend indicates a pressing need for healthcare providers to address the challenges associated with neuropathic pain, thereby creating opportunities for pharmaceutical companies and medical device manufacturers to innovate and expand their offerings in this sector.