Growing Awareness of Gut Health

The increasing awareness of gut health among the Indian population is driving the microbiome sequencing-services market. As consumers become more informed about the role of gut microbiota in overall health, there is a rising demand for services that can analyze and optimize gut health. This trend is reflected in the growing number of health and wellness programs that emphasize the importance of microbiome diversity. Reports indicate that the gut health market in India is projected to grow at a CAGR of approximately 15% over the next five years. This heightened awareness is likely to lead to increased utilization of microbiome sequencing services, as individuals seek personalized insights into their gut health and its implications for conditions such as obesity, diabetes, and digestive disorders.

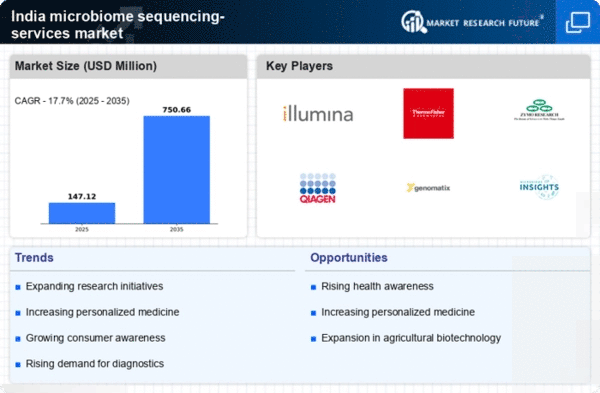

Expansion of Research Initiatives

The expansion of research initiatives in India is significantly impacting the microbiome sequencing-services market. Numerous academic institutions and research organizations are increasingly focusing on microbiome studies, which are essential for understanding the complex interactions between human health and microbiota. Government funding for research in biotechnology and genomics has seen a notable increase, with allocations reaching approximately $200 million in recent years. This financial support is likely to foster innovation and development in microbiome sequencing technologies, thereby enhancing service offerings. As research progresses, the insights gained are expected to translate into practical applications, further driving demand for microbiome sequencing services in clinical and commercial settings.

Increased Investment in Biotechnology

Increased investment in biotechnology is a pivotal driver for the microbiome sequencing-services market. The Indian government and private sector are recognizing the potential of biotechnology in healthcare, leading to substantial funding and support for startups and established companies in this field. Reports indicate that the biotechnology sector in India is expected to reach $100 billion by 2025, with microbiome research being a key focus area. This influx of capital is likely to accelerate the development of innovative sequencing technologies and services, thereby expanding the market. As more companies enter the microbiome sequencing space, competition is expected to drive improvements in service quality and affordability, benefiting consumers.

Rising Prevalence of Lifestyle Diseases

The rising prevalence of lifestyle diseases in India is a critical driver for the microbiome sequencing-services market. Conditions such as obesity, diabetes, and cardiovascular diseases are becoming increasingly common, prompting a shift towards preventive healthcare measures. Microbiome analysis has emerged as a promising tool for understanding the underlying factors contributing to these diseases. With an estimated 77 million people affected by diabetes in India, the potential for microbiome sequencing services to provide personalized dietary and lifestyle recommendations is substantial. This trend is likely to encourage healthcare providers to incorporate microbiome analysis into their treatment protocols, thereby expanding the market for sequencing services.

Technological Integration in Healthcare

The integration of advanced technologies in healthcare is transforming the microbiome sequencing-services market. Innovations such as artificial intelligence and machine learning are being utilized to analyze complex microbiome data, enabling more accurate interpretations and personalized recommendations. The Indian healthcare sector is increasingly adopting these technologies, with investments in health tech reaching approximately $1 billion in recent years. This technological evolution is expected to enhance the efficiency and accuracy of microbiome sequencing services, making them more accessible to healthcare providers and patients alike. As a result, the market is likely to experience significant growth as these services become an integral part of routine health assessments.