Increasing Healthcare Expenditure

The rise in healthcare expenditure in India is a key driver for the medical robotics market. As the country invests more in healthcare infrastructure, hospitals are seeking advanced technologies to enhance service delivery. The medical robotics market is expected to benefit from this trend, with an anticipated growth rate of 17% as healthcare facilities upgrade their surgical capabilities. Increased funding for healthcare services allows for the procurement of state-of-the-art robotic systems, which can improve surgical outcomes and operational efficiency. This trend indicates a shift towards high-quality healthcare services, further propelling the medical robotics market.

Government Initiatives and Funding

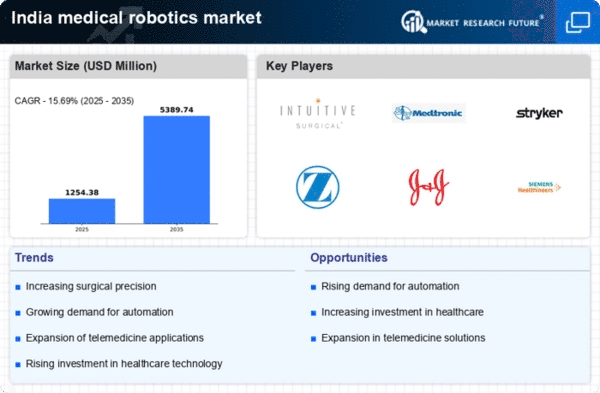

Government initiatives play a crucial role in the growth of the medical robotics market in India. The Indian government has been actively promoting healthcare innovation through various schemes and funding programs. For instance, initiatives aimed at enhancing healthcare infrastructure and technology adoption are encouraging hospitals to invest in robotic systems. The allocation of funds for research and development in medical robotics is expected to increase, potentially leading to a market growth of around 15% over the next few years. Such support from the government not only boosts the medical robotics market but also fosters collaboration between public and private sectors.

Technological Advancements in Robotics

The medical robotics market in India is experiencing a surge due to rapid technological advancements. Innovations in robotic systems, such as enhanced precision and minimally invasive techniques, are transforming surgical procedures. The integration of advanced imaging technologies and real-time data analytics is enabling surgeons to perform complex operations with greater accuracy. As a result, hospitals are increasingly investing in robotic systems, leading to a projected growth rate of approximately 20% annually in the medical robotics market. This trend is likely to continue as more healthcare facilities recognize the benefits of robotic-assisted surgeries, which can reduce recovery times and improve patient outcomes.

Growing Awareness and Acceptance of Robotics

There is a notable increase in awareness and acceptance of robotic technologies among healthcare professionals and patients in India. Educational initiatives and successful case studies are contributing to a better understanding of the benefits of robotic-assisted surgeries. As more surgeons become trained in using robotic systems, the medical robotics market is likely to expand. This growing acceptance may lead to a market growth of around 16% as patients increasingly seek out facilities that offer robotic surgery options. The positive perception of robotics in healthcare is essential for the continued evolution of the medical robotics market.

Rising Demand for Minimally Invasive Procedures

There is a growing demand for minimally invasive surgical procedures in India, which is significantly impacting the medical robotics market. Patients are increasingly opting for surgeries that promise shorter recovery times and reduced postoperative pain. Robotic-assisted surgeries, which align with this demand, are becoming more prevalent. The market is projected to grow by approximately 18% as more healthcare providers adopt robotic systems to meet patient expectations. This shift towards minimally invasive techniques is likely to drive further innovation in the medical robotics market, as manufacturers strive to develop more sophisticated and efficient robotic solutions.