India Maritime Decarbonization Market Overview:

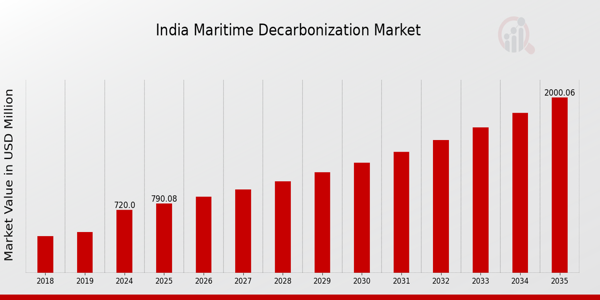

As per MRFR analysis, the India Maritime Decarbonization Market Size was estimated at 663.03 (USD Million) in 2023.The India Maritime Decarbonization Market is expected to grow from 720(USD Million) in 2024 to 2,000 (USD Million) by 2035. The India Maritime Decarbonization Market CAGR (growth rate) is expected to be around 9.733% during the forecast period (2025 - 2035).

Key India Maritime Decarbonization Market Trends Highlighted

The nation's dedication to sustainable practices in response to climate change is driving noteworthy trends in the India Maritime Decarbonization Market. In line with international sustainability goals, the Indian government is aggressively pushing legislation to lower carbon emissions from maritime activity.

Investment in decarbonization solutions is encouraged by programs like the National Maritime Development Programme, which seeks to improve infrastructure and advance greener technology. As a result, there is a strong push for the use of alternative fuels like hydrogen and LNG as well as improvements in ship battery technology.

The market offers a wealth of opportunities, especially for businesses that create and apply cutting-edge technology that promote emission reduction. Local businesses can adopt green shipping techniques more easily if the government offers financial incentives for research and development.

Furthermore, collaborations between the public and private sectors are becoming more and more crucial in advancing environmentally friendly shipping options since they enable a coordinated strategy to reduce emissions.

Spurred by the International Maritime Organization's directives, recent trends show that Indian shipping companies are becoming more interested in retrofitting existing vessels with cleaner technologies to satisfy new regulatory norms.

The adoption of the Ship Energy Efficiency Management Plan (SEEMP) is a proof that the shipping industry has realized the importance of tracking and enhancing energy efficiency. Additionally, there is pressure on maritime operators to implement sustainable practices due to increased public awareness of environmental issues.

All things considered, these patterns show a general movement in India's direction toward a more environmentally friendly shipping sector, encouraging creativity and cooperation and establishing the nation as a possible leader in maritime decarbonization.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

India Maritime Decarbonization Market Drivers

Government Initiatives for Environmental Sustainability

The Indian government is actively promoting initiatives aimed at reducing carbon emissions in the maritime sector. Programs such as the National Maritime Development Programme emphasize the adoption of eco-friendly technologies. According to a report by the Ministry of Shipping, the government has set a target to reduce greenhouse gas emissions by 33 to 35 percent by 2030 from 2005 levels.

This regulatory push is expected to stimulate investment in the India Maritime Decarbonization Market as companies like the Shipping Corporation of India are already exploring cleaner fuel alternatives and sustainable practices, driving development and increasing market growth opportunities.

Rising Environmental Awareness Among Consumers

There is a growing awareness among consumers about the impact of maritime activities on the environment, pushing companies to adopt sustainable practices. The Indian Chamber of Commerce reported that 70 percent of consumers consider sustainability an important factor when choosing shipping services.

This shift in consumer preferences is compelling maritime companies to invest in decarbonization technologies. For instance, significant players such as Maersk India are prioritizing investments in greener shipping solutions, responding to increased demand for environmentally friendly transport options, thereby fostering growth in the India Maritime Decarbonization Market.

Global Shipping Regulations and Standards

As part of a global effort to combat climate change, International Maritime Organization regulations are pushing for a significant reduction in ship emissions starting from 2023. India's compliance with these regulations is crucial, given its positioning as one of the world's largest shipping markets.

The Indian Shipowners Association highlighted that stringent adherence to these standards could result in an investment surge of USD 100 million in emission control technologies over the next five years within the India Maritime Decarbonization Market, thus propelling the growth of cleaner and more efficient maritime operations.

India Maritime Decarbonization Market Segment Insights:

Maritime Decarbonization Market Renewable Fuel Type Insights

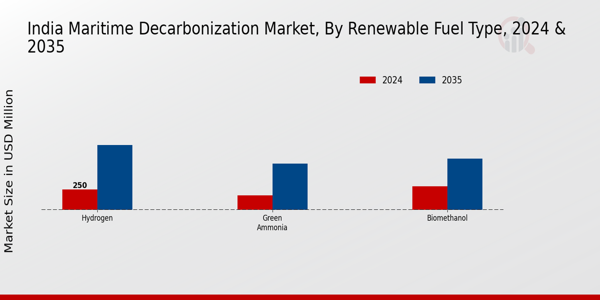

The Renewable Fuel Type segment within the India Maritime Decarbonization Market is gaining significant traction as the country works towards sustainable maritime practices. This market includes a variety of promising alternative fuels essential for reducing greenhouse gas emissions in the shipping industry.

Green Ammonia stands out due to its potential as a carbon-free fuel that, when utilized, produces no direct CO2 emissions, making it a crucial player in the decarbonization efforts of maritime transportation.

With a growing focus on developing ammonia-powered vessels, India is exploring various pathways to produce Green Ammonia sustainably, tapping into its vast renewable energy resources, including solar and wind, to generate hydrogen for ammonia synthesis.

Hydrogen, as a fuel source, also presents substantial opportunities, particularly through the use of green hydrogen produced from renewable sources.

The utilization of hydrogen fuel cells in maritime vessels can enhance energy efficiency and reduce reliance on traditional fossil fuels. India’s commitment to advancing its hydrogen economy under national policies supports significant investments in infrastructure and technology development, ensuring hydrogen's role in maritime decarbonization is further solidified.

Biomethanol, on the other hand, serves as another critical renewable fuel type, drawing attention for its capacity to be derived from various organic feedstocks. This versatility allows India to incorporate local agricultural waste and biomass into the production chain, thereby promoting circular economy principles.

Moreover, as global shipping regulations become increasingly stringent, biomethanol offers a pragmatic solution through its compatibility with existing engine technologies, making retrofitting of vessels more feasible.

The Indian government and industry stakeholders are recognizing these renewable fuel types as not merely alternatives but integral parts of future maritime operations. The emphasis on research, development and deployment of these cleansed energy sources is likely to shape innovations in vessel design and operation methods aimed at achieving net-zero emissions.

As industries align with international maritime standards, the focus on these renewable options is expected to drive significant investment and advancement in related infrastructure, thus establishing a roadmap for sustainable maritime energy management in India.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Maritime Decarbonization Market Application Insights

The India Maritime Decarbonization Market is witnessing significant growth particularly within the Application segment, which encompasses critical areas such as Ships, Ports, and Others. The maritime industry in India is increasingly recognizing the urgent need for decarbonization to meet international environmental standards and reduce greenhouse gas emissions.

Ships play a pivotal role in this transition, as they account for a substantial portion of emissions, making them a focal point for innovative technologies such as alternative fuels and energy-efficient designs. Meanwhile, Ports are becoming integral to this movement, evolving into hubs of sustainability by adopting cleaner operations and investing in infrastructure that supports eco-friendly shipping practices.

Other applications in the sector also contribute significantly, including advancements in logistics and waste management that align with decarbonization objectives.

With the Indian government actively promoting policies and initiatives that encourage green shipping, opportunities within the India Maritime Decarbonization Market are rapidly expanding, driven by both regulatory support and growing awareness of environmental impacts.

As these applications evolve, they are projected to dominate the market, supporting India's overall commitment toward achieving a sustainable maritime future.

India Maritime Decarbonization Market Key Players and Competitive Insights:

The India Maritime Decarbonization Market is rapidly evolving as the country strives to reduce greenhouse gas emissions from its shipping and marine sectors. Given India's extensive coastline and increasing maritime trade, the pressure to adopt cleaner technologies and sustainable practices is intensifying.

The competitive landscape is characterized by a mix of innovative local players and established global entities aiming to capitalize on the demand for green maritime solutions.

As shipping companies recognize the importance of sustainability not only for compliance but also for enhancing brand reputation and operational efficiency, various stakeholders are devising strategic partnerships and leveraging cutting-edge technologies to facilitate the transition toward decarbonization.

These shifts are essential to ensure that the maritime industry’s growth aligns with national and global decarbonization goals.

Makino Engineering's presence in the India Maritime Decarbonization Market showcases its commitment to providing high-performance machining solutions tailored for the maritime sector. The company leverages its expertise in precision engineering to facilitate the adoption of energy-efficient technologies among maritime stakeholders.

Makino Engineering has established a solid footprint in India, thanks to its innovative products that enhance operational efficiency and reduce carbon emissions. The company’s strengths lie in its advanced technological capabilities, enabling local shipbuilders and repair yards to optimize their processes while adhering to stringent environmental regulations.

Furthermore, Makino Engineering's focus on customer collaboration ensures that its solutions are tailored to meet the specific demands of the Indian market, enhancing their competitive positioning within the industry.

Kongsberg Gruppen plays a significant role in the India Maritime Decarbonization Market by providing a suite of innovative solutions designed to enhance the efficiency and sustainability of marine operations. The company specializes in advanced technology and automation systems that enable vessels to minimize emissions and optimize fuel consumption.

Kongsberg Gruppen's market presence in India is strengthened through strategic partnerships with local maritime firms and governmental agencies, focusing on fostering sustainable practices. Its key products include integrated ship systems that support emission reduction and efficiency improvements, positioning the company as a leader in enabling the maritime sector's transition to greener operations.

Kongsberg Gruppen also actively seeks growth through mergers and acquisitions that allow it to expand its technological offerings, ensuring it remains at the forefront of the decarbonization efforts in India. The company's unwavering commitment to innovation and sustainable technology reinforces its competitive edge within the region.

Key Companies in the India Maritime Decarbonization Market Include:

Makino Engineering

Kongsberg Gruppen

GE Marine

Indian Oil Corporation

Larsen & Toubro

Kawasaki Heavy Industries

Tata Steel

ABS

Bharat Petroleum Corporation

Jindal Steel and Power

DNV GL

Bureau Veritas

Hindustan Petroleum Corporation

Wartsila India

MAN Energy Solutions

India Maritime Decarbonization Market Developments

The India Maritime Decarbonization Market has seen significant developments lately, reflecting the nation’s commitment towards reducing carbon emissions in shipping. In October 2023, Indian Oil Corporation announced its focus on biofuels as a key strategy to decarbonize its maritime operations, aiming for sustainable energy dependency.

Manufacturing giants like Larsen and Toubro are pushing towards developing green technologies, with recent partnerships leading to innovations in alternative fuels and energy-efficient ship designs. Meanwhile, companies such as Wartsila India are actively engaging in Research and Development to optimize engine performance for lower emissions.

In September 2023, Bharat Petroleum Corporation partnered with DNV GL to enhance operational efficiency, showcasing a trend towards collaboration among industry stakeholders.

Market growth is notable; a 15% increase in valuation was recorded in 2023, driven by rising investments in renewable energy solutions, prompting companies like Makino Engineering and Kongsberg Gruppen to expand their offerings in this space.

Furthermore, the Indian government’s push for a green maritime economy aligns with companies including GE Marine and Tata Steel, facilitating advancements in decarbonization initiatives. The landscape is evolving rapidly, reflecting a strong emphasis on sustainability in India’s vast maritime sector.

India Maritime Decarbonization Market Segmentation Insights

Maritime Decarbonization Market Renewable Fuel Type Outlook

Green Ammonia

Hydrogen

Biomethanol

Maritime Decarbonization Market Application Outlook

Ships

Ports

Others

FAQs

What is the projected market size of the India Maritime Decarbonization Market by 2035?

The India Maritime Decarbonization Market is projected to be valued at 2000.0 USD Million by 2035.

What was the market value of Green Ammonia in the year 2024?

In 2024, the market value for Green Ammonia is expected to be 180.0 USD Million.

What is the expected CAGR for the India Maritime Decarbonization Market from 2025 to 2035?

The market is expected to grow at a CAGR of 9.733% from 2025 to 2035.

Which renewable fuel type has the largest projected market size in 2035?

Hydrogen is projected to have the largest market size in 2035, valued at 800.0 USD Million.

What are some of the key players in the India Maritime Decarbonization Market?

Major players include GE Marine, Indian Oil Corporation, and Wartsila India among others.

What is the market value of Biomethanol in 2035?

The market value of Biomethanol is projected to be 630.0 USD Million in 2035.

What is the market size for Hydrogen in the year 2024?

The market size for Hydrogen is expected to be 250.0 USD Million in 2024.

What are the expected growth drivers for the India Maritime Decarbonization Market?

The growth drivers include increasing environmental regulations and demand for sustainable shipping solutions.

How does the India Maritime Decarbonization Market growth rate compare from 2025 to 2035?

The market is expected to grow at a steady rate, with a projected CAGR of 9.733% during the period.

What is the market value of the India Maritime Decarbonization Market in 2024?

The market is expected to be valued at 720.0 USD Million in the year 2024.

Kindly complete the form below to receive a free sample of this Report

Customer Stories

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”