Emergence of Cloud-Based LIMS Solutions

The emergence of cloud-based laboratory information management systems is transforming the India laboratory information management systems market. Cloud technology offers laboratories the flexibility to access data remotely, reduce IT infrastructure costs, and enhance collaboration among research teams. As organizations increasingly adopt cloud solutions, the market for cloud-based LIMS is projected to expand significantly. This shift is particularly beneficial for small to medium-sized laboratories that may lack the resources for extensive IT setups. The scalability and cost-effectiveness of cloud-based LIMS solutions are likely to attract a broader range of users, thereby driving market growth in the coming years.

Regulatory Compliance and Quality Assurance

In the India laboratory information management systems market, regulatory compliance and quality assurance are paramount. Laboratories are mandated to adhere to stringent regulations set forth by governing bodies such as the National Accreditation Board for Testing and Calibration Laboratories (NABL). LIMS solutions facilitate compliance by automating documentation processes and ensuring traceability of samples and results. This is particularly crucial in sectors such as pharmaceuticals and clinical research, where adherence to Good Laboratory Practices (GLP) is essential. The increasing focus on quality assurance is likely to propel the adoption of LIMS, as organizations seek to mitigate risks associated with non-compliance and enhance their operational credibility.

Rising Investment in Research and Development

The India laboratory information management systems market is witnessing a notable increase in investment in research and development (R&D). Government initiatives aimed at boosting innovation and scientific research are encouraging laboratories to adopt advanced technologies, including LIMS. The Indian government has allocated substantial funding to enhance R&D capabilities across various sectors, including healthcare and biotechnology. This influx of investment is expected to drive the demand for LIMS, as laboratories require sophisticated data management systems to support their research activities. Furthermore, the integration of LIMS with other laboratory instruments is anticipated to enhance data accuracy and facilitate collaborative research efforts.

Increased Focus on Data Analytics and Insights

The India laboratory information management systems market is increasingly focusing on data analytics and insights. Laboratories are recognizing the value of data-driven decision-making and are seeking LIMS solutions that offer advanced analytics capabilities. By leveraging data analytics, laboratories can gain insights into operational efficiencies, sample trends, and quality control metrics. This trend is particularly relevant in sectors such as clinical diagnostics and environmental testing, where data interpretation plays a crucial role in outcomes. The integration of analytics within LIMS is expected to enhance laboratory performance and support strategic planning, thereby contributing to the overall growth of the market.

Growing Demand for Efficient Laboratory Operations

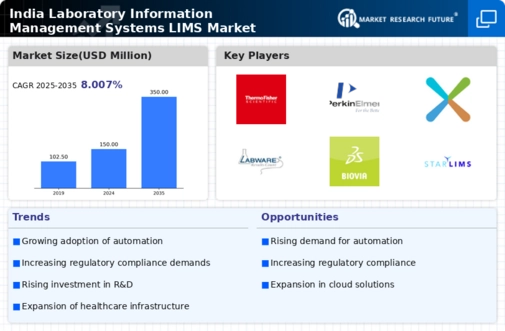

The India laboratory information management systems market is experiencing a surge in demand for efficient laboratory operations. Laboratories are increasingly seeking solutions that streamline workflows, reduce manual errors, and enhance productivity. The adoption of LIMS is seen as a strategic move to optimize resource allocation and improve turnaround times. According to recent data, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 12% over the next five years. This growth is driven by the need for laboratories to manage increasing sample volumes and complex data management requirements. As a result, LIMS solutions are becoming integral to laboratory operations, enabling better data tracking and reporting capabilities.