Emergence of Smart Technologies

The emergence of smart technologies is reshaping the flow computer market in India. With the advent of IoT and data analytics, flow computers are evolving to offer enhanced connectivity and data processing capabilities. This shift towards smart solutions allows for better monitoring and predictive maintenance, which can lead to significant cost savings for industries. The smart manufacturing market in India is anticipated to grow substantially, with investments in smart technologies expected to reach $2 billion by 2025. As industries embrace these innovations, the demand for advanced flow computers that integrate smart technologies is likely to rise, further propelling the growth of the flow computer market.

Expansion of Industrial Automation

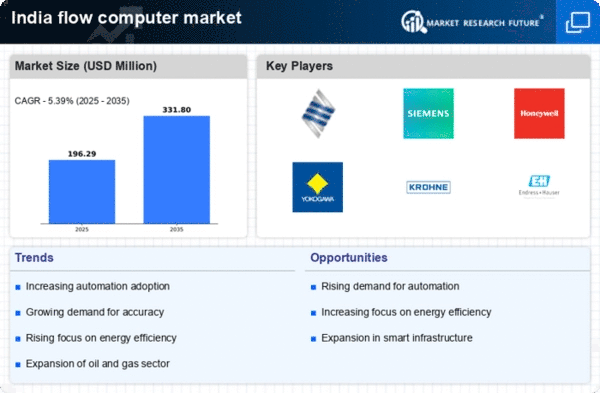

The flow computer market is significantly influenced by the ongoing expansion of industrial automation in India. As industries increasingly adopt automated processes, the need for precise measurement and control of fluid flow becomes paramount. Flow computers are integral to these automated systems, providing real-time data that enhances operational efficiency. The Indian automation market is expected to reach a valuation of $5 billion by 2026, indicating a robust growth trajectory. This expansion is likely to drive demand for flow computers, as industries seek to integrate advanced measurement technologies into their automated frameworks, thereby fostering growth in the flow computer market.

Rising Demand for Energy Efficiency

The flow computer market in India is experiencing a notable surge in demand driven by the increasing emphasis on energy efficiency across various sectors. Industries are actively seeking solutions that optimize resource utilization and minimize waste. This trend is particularly evident in the oil and gas sector, where flow computers play a crucial role in monitoring and managing energy consumption. According to recent data, the energy efficiency market in India is projected to grow at a CAGR of approximately 8% over the next five years. As companies strive to meet sustainability goals, the adoption of advanced flow computer technologies is likely to rise, thereby propelling the growth of the flow computer market.

Investment in Infrastructure Development

India's ambitious infrastructure development initiatives are poised to impact the flow computer market positively. The government's focus on enhancing transportation, energy, and water supply systems necessitates the implementation of advanced flow measurement technologies. With substantial investments earmarked for infrastructure projects, the demand for flow computers is expected to rise. For instance, the National Infrastructure Pipeline aims to invest over $1.4 trillion in various sectors by 2025. This influx of capital is likely to create opportunities for flow computer manufacturers, as industries involved in infrastructure development seek reliable solutions for fluid management, thereby stimulating growth in the flow computer market.

Increasing Focus on Safety and Compliance

The flow computer market in India is also driven by an increasing focus on safety and compliance within various industries. Regulatory bodies are enforcing stringent standards for fluid measurement and management, particularly in sectors such as oil and gas, chemicals, and pharmaceuticals. Flow computers are essential for ensuring compliance with these regulations, as they provide accurate data for reporting and monitoring purposes. The market for safety compliance solutions is projected to grow at a CAGR of around 10% in the coming years. As companies prioritize safety and regulatory adherence, the demand for advanced flow computer technologies is likely to increase, thereby enhancing the flow computer market.