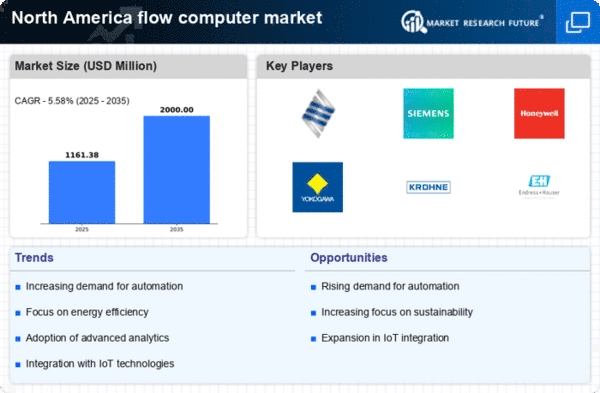

Focus on Energy Efficiency

The flow computer market in North America is increasingly driven by a focus on energy efficiency. As organizations strive to reduce their carbon footprint and operational costs, the demand for flow computers that facilitate energy-efficient processes is growing. This trend is particularly evident in sectors such as oil and gas, where optimizing flow rates can lead to significant energy savings. The market is projected to grow as companies seek solutions that not only enhance measurement accuracy but also contribute to sustainability goals. It is estimated that the flow computer market could expand by 10% annually as businesses prioritize energy-efficient technologies in their operations.

Integration of IoT Technologies

The integration of Internet of Things (IoT) technologies is significantly influencing the flow computer market in North America. As industries adopt smart technologies, the demand for flow computers that can seamlessly connect with IoT devices is on the rise. This integration allows for real-time data collection, monitoring, and analysis, which enhances operational efficiency and decision-making processes. The flow computer market is expected to witness a compound annual growth rate (CAGR) of around 8% over the next five years, largely attributed to the increasing adoption of IoT solutions. Companies are recognizing the potential of IoT-enabled flow computers to provide valuable insights and improve overall system performance.

Expansion of Smart Infrastructure

The expansion of smart infrastructure initiatives across North America is creating new opportunities for the flow computer market. As cities and industries invest in modernizing their infrastructure, the need for advanced flow measurement systems becomes paramount. Smart water management systems, for instance, require reliable flow computers to monitor and control water distribution effectively. This trend is likely to drive market growth as municipalities and private sectors seek to implement intelligent solutions that enhance resource management. The flow computer market is anticipated to benefit from these developments, with projections indicating a potential increase in market size by 15% over the next few years.

Increased Investment in Automation

Increased investment in automation technologies is a key driver for the flow computer market in North America. As industries seek to enhance productivity and reduce labor costs, the adoption of automated flow measurement systems is becoming more prevalent. This shift is particularly noticeable in manufacturing and processing sectors, where automated solutions can streamline operations and improve accuracy. The flow computer market is expected to grow as companies recognize the advantages of integrating automation into their processes. Analysts suggest that the market could see a growth rate of approximately 12% annually, reflecting the ongoing trend towards automation in various industries.

Rising Demand for Accurate Measurement

The flow computer market in North America is experiencing a notable increase in demand for precise measurement solutions. Industries such as oil and gas, water management, and chemical processing require high accuracy in flow measurement to optimize operations and ensure compliance with regulatory standards. The need for accurate data is further emphasized by the growing emphasis on efficiency and cost reduction. According to recent estimates, the flow computer market is projected to reach approximately $1.5 billion by 2026, driven by the necessity for reliable measurement systems. This trend indicates that companies are increasingly investing in advanced flow computer technologies to enhance their operational capabilities and maintain competitive advantages in the market.