Emergence of Smart Technologies

The integration of smart technologies into the flow computer market is reshaping the landscape in South America. The advent of IoT and advanced data analytics is enabling flow computers to provide enhanced functionalities, such as predictive maintenance and remote monitoring. This technological evolution is particularly relevant in sectors like oil and gas, where operational efficiency is paramount. Companies are increasingly adopting smart flow computers to gain insights into their processes, potentially reducing downtime and maintenance costs by up to 30%. As the trend towards digitalization continues, the flow computer market is expected to expand, driven by the demand for intelligent solutions that enhance operational performance.

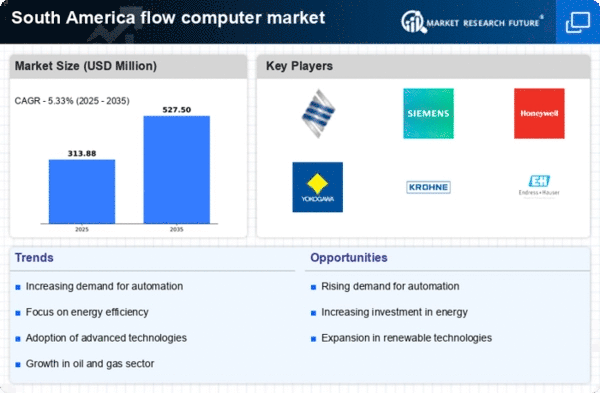

Growing Focus on Energy Efficiency

The The South America market is significantly influenced by the increasing emphasis on energy efficiency.. As countries strive to meet international climate commitments, there is a growing need for technologies that optimize energy consumption. Flow computers play a vital role in monitoring and managing energy use across various sectors, including manufacturing and utilities. For example, the implementation of flow measurement systems can lead to energy savings of up to 20%, which is particularly appealing in a region where energy costs are rising. This focus on efficiency is likely to propel the adoption of flow computers, as businesses seek to reduce their carbon footprint while maintaining operational effectiveness.

Rising Demand for Accurate Measurement

The The South America market is experiencing a notable increase in demand for precise measurement solutions.. Industries such as oil and gas, water management, and chemical processing are increasingly reliant on accurate flow measurement to optimize operations and ensure compliance with industry standards. The need for reliable data is underscored by the fact that inaccurate measurements can lead to significant financial losses, estimated at up to $1 million annually for large-scale operations. As a result, companies are investing in advanced flow computer technologies that provide real-time data and enhance operational efficiency. This trend is likely to drive growth in the flow computer market, as businesses seek to improve their measurement capabilities and reduce operational risks.

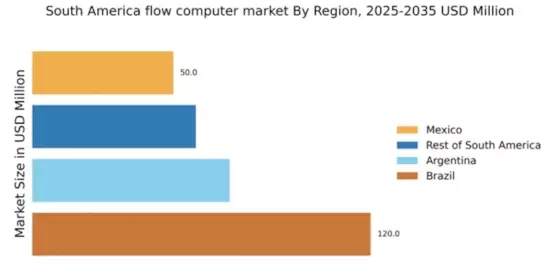

Investment in Infrastructure Development

Infrastructure development in South America is a critical driver for the flow computer market. Governments and private sectors are investing heavily in upgrading and expanding infrastructure, particularly in the energy and water sectors. For instance, Brazil's investment in its oil and gas infrastructure is projected to reach $100 billion by 2025, creating a substantial demand for flow measurement solutions. This investment is expected to enhance the efficiency of resource extraction and distribution, thereby increasing the need for sophisticated flow computers. As infrastructure projects progress, the flow computer market is likely to benefit from the heightened demand for reliable measurement systems that can support these large-scale initiatives.

Regulatory Pressure for Environmental Compliance

Regulatory frameworks in South America are becoming increasingly stringent regarding environmental compliance, which is a significant driver for the flow computer market. Industries are required to adhere to regulations that mandate accurate reporting of emissions and resource usage. For instance, the implementation of stricter environmental laws in countries like Argentina and Chile is pushing companies to invest in advanced flow measurement technologies. This regulatory pressure is likely to result in a surge in demand for flow computers that can provide precise data for compliance reporting. As businesses strive to meet these regulations, the flow computer market is expected to grow, driven by the need for reliable measurement solutions that support environmental sustainability.