Growing Focus on Cybersecurity Measures

The enterprise VSAT market is increasingly influenced by the growing focus on cybersecurity measures among organizations in India. As businesses become more aware of the potential threats posed by cyberattacks, there is a heightened demand for secure communication channels. Satellite communication is perceived as a more secure option compared to traditional internet connections, particularly in sensitive sectors such as finance and defense. By 2025, it is anticipated that approximately 50% of enterprises in India will prioritize satellite communication for their critical operations, thereby driving growth in the enterprise vsat market. This trend underscores the importance of security in shaping the future of communication solutions.

Increased Adoption of Remote Work Solutions

The enterprise vsat market in India is experiencing a notable surge due to the increased adoption of remote work solutions. Organizations are increasingly relying on satellite communication to ensure seamless connectivity for their remote workforce. This trend is particularly pronounced in sectors such as IT, education, and healthcare, where reliable internet access is crucial. As of 2025, it is estimated that around 60% of enterprises in India have integrated satellite communication into their operations, reflecting a growing recognition of the importance of robust connectivity. The enterprise vsat market is thus positioned to benefit from this shift, as companies seek to enhance productivity and collaboration among distributed teams.

Rising Demand for Disaster Recovery Solutions

The enterprise VSAT market is witnessing a rising demand for disaster recovery solutions, particularly in India, where natural disasters can disrupt traditional communication infrastructure. Organizations are increasingly recognizing the importance of having backup communication systems in place to ensure business continuity. Satellite communication offers a reliable alternative that can be deployed quickly in the aftermath of a disaster. As of 2025, it is estimated that around 40% of enterprises in India have implemented satellite-based disaster recovery solutions, highlighting the critical role of the enterprise vsat market in enhancing resilience against unforeseen events. This trend is likely to drive further investments in satellite technology.

Government Initiatives for Digital Infrastructure

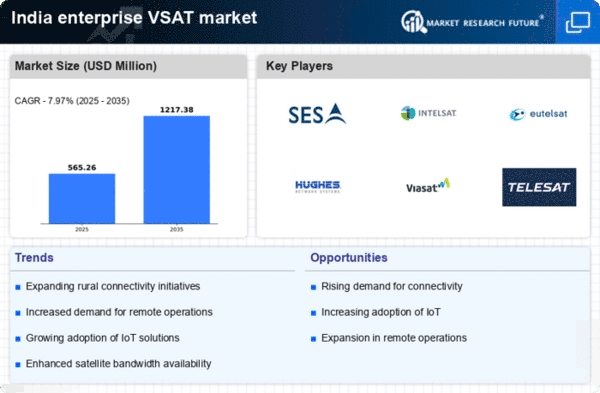

The enterprise VSAT market is benefiting from various government initiatives aimed at enhancing digital infrastructure across India. Programs such as Digital India and initiatives to improve connectivity in rural areas are fostering an environment conducive to the growth of satellite communication solutions. The government has set ambitious targets to increase internet penetration, which is expected to reach 80% by 2025. This push for improved connectivity is likely to create new opportunities for the enterprise vsat market, as businesses seek to leverage satellite technology to meet the demands of a digitally connected economy. The supportive regulatory framework further enhances the attractiveness of this market.

Expansion of Internet of Things (IoT) Applications

The enterprise vsat market is significantly influenced by the expansion of Internet of Things (IoT) applications across various industries in India. As businesses increasingly deploy IoT devices for monitoring and data collection, the need for reliable and widespread connectivity becomes paramount. The enterprise vsat market is poised to capture a substantial share of this demand, particularly in sectors such as agriculture, logistics, and manufacturing. By 2025, it is projected that the number of IoT devices in India will exceed 1 billion, driving the need for satellite communication solutions that can support these devices in remote and rural areas. This trend indicates a promising growth trajectory for the enterprise vsat market.