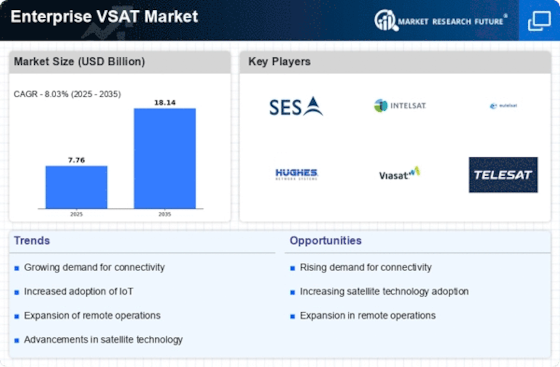

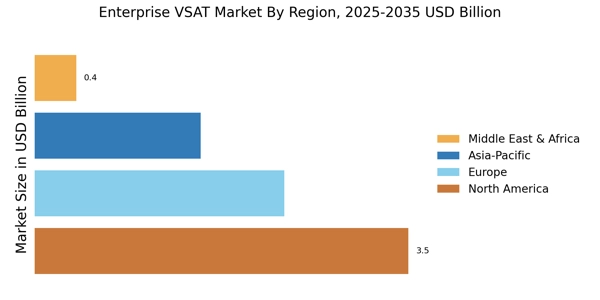

North America : Leading Innovation and Demand

North America is the largest market for Enterprise VSAT Market, holding approximately 45% of the global share. The region's growth is driven by increasing demand for high-speed internet in remote areas, advancements in satellite technology, and supportive regulatory frameworks. The U.S. and Canada are the primary contributors, with significant investments in infrastructure and technology, enhancing connectivity and service delivery. The competitive landscape is dominated by key players such as SES S.A., Intelsat S.A., and Hughes Network Systems, LLC. These companies are leveraging innovative technologies to expand their service offerings. The presence of established firms and a growing number of startups in the satellite communications sector further fuels competition, ensuring a dynamic market environment.

Europe : Emerging Market with Potential

Europe is witnessing a significant rise in the Enterprise VSAT Market, accounting for approximately 30% of the global share. The growth is propelled by increasing demand for reliable communication solutions in various sectors, including maritime, aviation, and remote operations. Regulatory support from the European Space Agency and national governments is fostering innovation and investment in satellite technologies, enhancing market dynamics. Leading countries in this region include the United Kingdom, France, and Germany, where major players like Eutelsat Communications S.A. and Inmarsat Global Limited are actively expanding their services. The competitive landscape is characterized by collaborations and partnerships aimed at enhancing service delivery and technological advancements, positioning Europe as a key player in The Enterprise VSAT Market. Regional adoption is accelerating across the UK enterprise vsat market, France enterprise vsat market, Germany enterprise vsat market, Italy enterprise vsat market, and Spain enterprise vsat market, driven by maritime connectivity, aviation communications, and enterprise digital modernization initiatives.

Asia-Pacific : Rapidly Growing Market Dynamics

Asia-Pacific is emerging as a significant player in the Enterprise VSAT Market, holding around 20% of the global share. The region's growth is driven by increasing internet penetration, demand for mobile connectivity, and government initiatives to improve communication infrastructure. Countries like India and Australia are leading the charge, supported by favorable regulations and investments in satellite technology. The competitive landscape features key players such as Viasat, Inc. and Speedcast International Limited, who are focusing on expanding their service offerings to meet the diverse needs of the region. The presence of a growing number of local providers is also enhancing competition, driving innovation and improving service quality across various sectors, including telecommunications and maritime.

Middle East and Africa : Untapped Potential and Growth

The Middle East and Africa region is gradually developing its Enterprise VSAT Market, currently holding about 5% of the global share. The growth is primarily driven by increasing demand for connectivity in remote areas, coupled with government initiatives aimed at enhancing digital infrastructure. Countries like South Africa and the UAE are at the forefront, with investments in satellite technology and regulatory support fostering market growth. The competitive landscape is characterized by a mix of international and local players, including Iridium Communications Inc. and Telesat Canada. The presence of these companies is crucial for expanding service availability and improving connectivity in underserved regions. As the market matures, opportunities for growth and innovation are expected to increase, attracting further investments. Growth in the GCC enterprise vsat market highlights expanding satellite adoption to support energy operations, remote enterprise connectivity, and regional digital transformation programs.