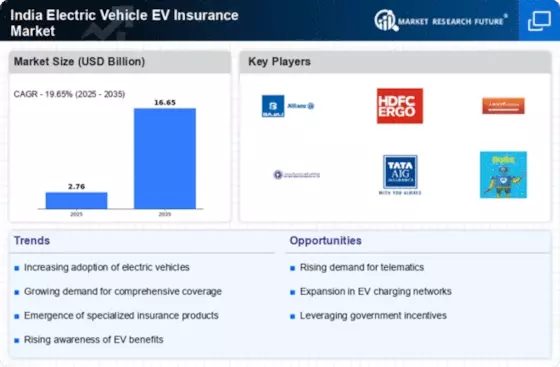

Growing Electric Vehicle Adoption

The India Electric Vehicle Ev Insurance Market is experiencing a surge in demand due to the increasing adoption of electric vehicles (EVs). As of January 2026, the number of registered electric vehicles in India has surpassed 1.5 million, reflecting a significant growth trajectory. This rise is driven by government initiatives aimed at promoting sustainable transportation, such as the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme. Consequently, the growing EV population necessitates specialized insurance products tailored to the unique risks associated with electric vehicles, including battery damage and charging infrastructure. Insurers are responding by developing comprehensive policies that cater to the specific needs of EV owners, thereby enhancing the overall market landscape.

Government Policies and Incentives

The India Electric Vehicle Ev Insurance Market is significantly influenced by favorable government policies and incentives designed to promote electric vehicle adoption. The Indian government has implemented various schemes, such as tax rebates and subsidies for EV buyers, which indirectly bolster the insurance market. For instance, the GST on electric vehicles is set at 5%, compared to 28% for conventional vehicles, making EVs more attractive to consumers. This policy environment encourages more individuals to invest in electric vehicles, thereby increasing the demand for tailored insurance products. As the government continues to support the transition to electric mobility, the insurance sector is likely to see a corresponding rise in policy uptake, further solidifying its role in the EV ecosystem.

Increased Competition Among Insurers

The India Electric Vehicle Ev Insurance Market is characterized by increased competition among insurers, which is driving innovation and improving service offerings. As more players enter the market, they are compelled to differentiate themselves through unique products and competitive pricing. This competitive landscape encourages insurers to develop specialized policies that cater specifically to the needs of electric vehicle owners, such as coverage for battery replacement and charging station damage. Additionally, insurers are investing in marketing strategies to educate consumers about the benefits of EV insurance, further expanding the market. This heightened competition is likely to lead to better customer experiences and more comprehensive insurance solutions tailored to the evolving needs of the electric vehicle market.

Technological Innovations in Insurance

The India Electric Vehicle Ev Insurance Market is witnessing a transformation driven by technological innovations in insurance solutions. Insurers are increasingly leveraging data analytics, telematics, and artificial intelligence to enhance their offerings. For example, telematics devices can monitor driving behavior, allowing insurers to offer personalized premiums based on actual usage patterns. This approach not only improves customer satisfaction but also encourages safer driving among EV owners. Furthermore, the integration of mobile applications for policy management and claims processing streamlines the customer experience. As technology continues to evolve, it is expected that the insurance market will adapt, providing more efficient and user-friendly solutions tailored to the needs of electric vehicle owners.

Environmental Awareness and Sustainability

The India Electric Vehicle Ev Insurance Market is also propelled by a growing awareness of environmental issues and the push for sustainability. As consumers become more conscious of their carbon footprint, the demand for electric vehicles has surged. This shift in consumer behavior is influencing the insurance market, as individuals seek policies that align with their values. Insurers are responding by offering green insurance products that not only cover traditional risks but also promote eco-friendly practices. For instance, some insurers provide discounts for EV owners who participate in sustainable initiatives, such as using renewable energy for charging. This alignment of insurance offerings with environmental values is likely to attract more customers to the electric vehicle insurance market.