Growing Electric Vehicle Adoption

The increasing adoption of electric vehicles (EVs) in Germany is a primary driver for the Germany Electric Vehicle Ev Insurance Market. As of January 2026, approximately 1.5 million electric vehicles are registered in Germany, reflecting a significant rise in consumer preference for sustainable transportation. This trend is bolstered by government initiatives aimed at reducing carbon emissions and promoting green technologies. The German government has set ambitious targets for EV adoption, aiming for 15 million electric vehicles on the roads by 2030. Consequently, the demand for specialized insurance products tailored to EVs is likely to surge, as consumers seek coverage that addresses the unique risks associated with electric vehicles, such as battery damage and charging infrastructure.

Technological Advancements in EVs

Technological advancements in electric vehicles are reshaping the landscape of the Germany Electric Vehicle Ev Insurance Market. Innovations such as enhanced battery technology, autonomous driving features, and improved safety systems are becoming commonplace in new EV models. These advancements not only increase the appeal of electric vehicles but also influence insurance underwriting processes. Insurers are likely to adjust their policies to reflect the reduced risk associated with newer, safer models. For instance, vehicles equipped with advanced driver-assistance systems (ADAS) may qualify for lower premiums. As the technology continues to evolve, the insurance market must adapt, creating opportunities for tailored products that cater to the specific needs of EV owners.

Increased Competition Among Insurers

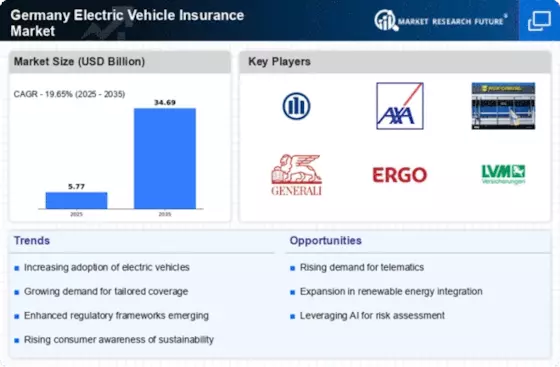

The competitive landscape of the Germany Electric Vehicle Ev Insurance Market is intensifying as more insurers enter the market. With the growing number of electric vehicles, traditional insurers are expanding their offerings to include specialized EV insurance products. This increased competition is likely to lead to more innovative and affordable insurance solutions for consumers. Insurers are also leveraging data analytics to better understand the risks associated with electric vehicles, allowing them to tailor their policies more effectively. As a result, consumers may benefit from a wider range of options and potentially lower premiums, further stimulating the growth of the EV insurance market in Germany.

Government Regulations and Incentives

Government regulations and incentives play a crucial role in shaping the Germany Electric Vehicle Ev Insurance Market. The German government has implemented various policies to encourage the adoption of electric vehicles, including tax breaks, subsidies, and grants for EV buyers. These incentives not only lower the initial cost of purchasing an electric vehicle but also promote the development of a robust charging infrastructure. As a result, the insurance market is likely to see an increase in demand for EV-specific policies that align with these government initiatives. Furthermore, regulatory frameworks that mandate insurance coverage for electric vehicles may emerge, further driving the growth of the market.

Environmental Concerns and Sustainability

Growing environmental concerns and the push for sustainability are significant drivers of the Germany Electric Vehicle Ev Insurance Market. As awareness of climate change and pollution increases, consumers are increasingly inclined to choose electric vehicles over traditional combustion engine cars. This shift is reflected in the rising sales of EVs, which are perceived as a more environmentally friendly option. Insurers are responding to this trend by developing products that not only cover the vehicles but also promote sustainable practices. For instance, some insurance companies offer discounts for EV owners who utilize renewable energy sources for charging. This alignment with consumer values is likely to enhance the attractiveness of EV insurance products.