Regulatory Support and Framework Development

The regulatory landscape for the India drones market is evolving rapidly, with the government actively formulating policies to facilitate drone operations. The Ministry of Civil Aviation has introduced the Drone Rules 2021, which aim to simplify the process of obtaining licenses and permissions for drone usage. This regulatory support is crucial as it encourages investment and innovation within the industry. Furthermore, the government has established a framework for drone delivery services, which is expected to enhance logistics and supply chain efficiency. As a result, the India drones market is likely to witness increased participation from both domestic and international players, fostering a competitive environment that could lead to technological advancements and improved service offerings.

Growing Adoption in Agriculture and Logistics

The agriculture sector in India is increasingly embracing drone technology, which is transforming traditional farming practices. Drones are being utilized for crop monitoring, precision agriculture, and pesticide spraying, leading to enhanced productivity and reduced operational costs. The India drones market is witnessing a surge in demand from farmers seeking to leverage these technologies for better yield management. Additionally, the logistics sector is also adopting drones for last-mile delivery solutions, particularly in remote areas. This trend is supported by government initiatives aimed at improving rural connectivity and infrastructure. As a result, the India drones market is expected to expand significantly, with agriculture and logistics being key drivers of this growth.

Increased Investment and Funding Opportunities

Investment in the India drones market is on the rise, with both public and private sectors recognizing the potential of drone technology. The government has launched various initiatives to promote research and development in this field, including funding for startups and collaborations with academic institutions. Venture capital firms are also increasingly interested in drone technology, leading to a surge in funding for innovative drone startups. This influx of capital is likely to accelerate the development of new applications and services within the India drones market. As a result, the market is expected to attract a diverse range of players, from established companies to emerging startups, fostering a dynamic ecosystem that could drive further advancements.

Technological Advancements in Drone Capabilities

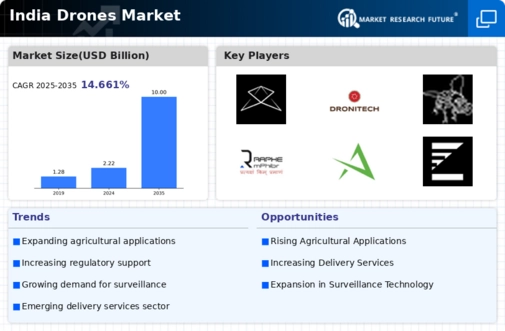

Technological innovation plays a pivotal role in shaping the India drones market. Recent advancements in drone technology, such as improved battery life, enhanced payload capacities, and sophisticated navigation systems, are driving the adoption of drones across various sectors. For instance, the integration of artificial intelligence and machine learning in drone operations is enabling more efficient data collection and analysis. According to industry reports, the market for drone technology in India is projected to grow at a CAGR of over 15% from 2023 to 2028. This growth is indicative of the increasing reliance on drones for applications ranging from surveillance to agricultural monitoring, thereby expanding the scope of the India drones market.

Rising Demand for Surveillance and Security Solutions

The need for enhanced surveillance and security measures is propelling the growth of the India drones market. Drones are being deployed for various security applications, including border surveillance, crowd monitoring, and disaster management. The government and private sectors are increasingly investing in drone technology to bolster national security and public safety. According to recent estimates, the market for security drones in India is expected to grow significantly, driven by the rising concerns over safety and security. This trend indicates a broader acceptance of drone technology across different sectors, thereby expanding the overall scope of the India drones market.