Growing Awareness of Oral Health

There is a marked increase in public awareness regarding oral health, which is positively impacting the dental radiology-imaging-devices market. Educational campaigns and initiatives by health organizations in Germany have led to a greater understanding of the importance of regular dental check-ups and early detection of oral diseases. This heightened awareness is resulting in more patients seeking preventive care, which often involves the use of advanced imaging technologies. As a result, dental practices are increasingly adopting sophisticated imaging devices to cater to this demand. The market is expected to witness a growth rate of approximately 5% annually as more individuals prioritize their oral health and seek out advanced diagnostic tools.

Increasing Demand for Cosmetic Dentistry

The rising popularity of cosmetic dentistry is significantly influencing the dental radiology-imaging-devices market. As more patients seek aesthetic dental procedures, the need for precise imaging to plan and execute these treatments becomes paramount. In Germany, the cosmetic dentistry sector has seen a notable increase, with a reported growth rate of around 6% annually. This trend necessitates advanced imaging solutions that can provide high-resolution images for procedures such as veneers, implants, and orthodontics. Consequently, dental practitioners are investing in state-of-the-art imaging devices to meet patient expectations and enhance treatment outcomes, thereby driving the demand within the dental radiology-imaging-devices market.

Integration of Imaging with Digital Workflow

The integration of imaging technologies with digital workflows is transforming the dental radiology-imaging-devices market. Dental practices in Germany are increasingly adopting digital solutions that streamline the patient experience, from initial consultation to treatment planning. This integration allows for seamless data sharing between imaging devices and practice management software, enhancing efficiency and accuracy. As practices seek to improve operational workflows and patient satisfaction, the demand for imaging devices that can easily integrate with digital platforms is on the rise. This trend is expected to contribute to a market growth rate of around 6.5% in the coming years, as more dental professionals recognize the benefits of a fully integrated digital workflow.

Technological Advancements in Imaging Devices

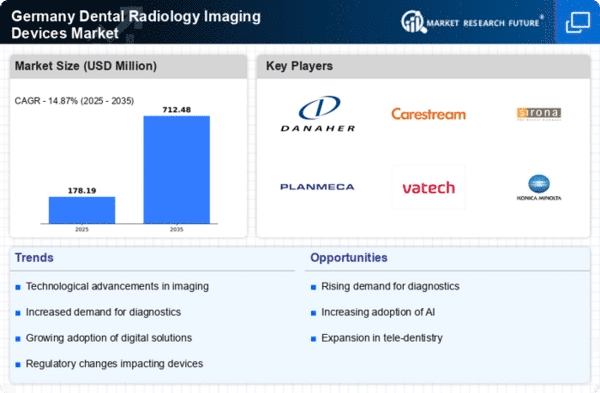

The dental radiology-imaging-devices market is experiencing a surge in technological advancements, particularly in digital imaging technologies. Innovations such as cone beam computed tomography (CBCT) and 3D imaging systems are enhancing diagnostic accuracy and treatment planning. These technologies allow for detailed visualization of dental structures, which is crucial for effective patient management. In Germany, the market for dental imaging devices is projected to grow at a CAGR of approximately 7.5% from 2025 to 2030, driven by the increasing adoption of these advanced imaging modalities. Furthermore, the integration of artificial intelligence in imaging devices is expected to streamline workflows and improve diagnostic capabilities, thereby propelling the growth of the dental radiology-imaging-devices market.

Regulatory Support for Advanced Imaging Technologies

Regulatory bodies in Germany are actively supporting the development and implementation of advanced imaging technologies in the dental sector. This support is evident through streamlined approval processes for new devices and the establishment of guidelines that encourage innovation. The dental radiology-imaging-devices market benefits from these regulatory frameworks, which facilitate the introduction of cutting-edge technologies that enhance diagnostic capabilities. As a result, manufacturers are more inclined to invest in research and development, leading to a wider array of imaging solutions available in the market. This regulatory environment is likely to foster growth, with projections indicating a potential market expansion of 8% over the next five years.