Rising Awareness of Oral Health

The increasing awareness of oral health among the South Korean population is a pivotal driver for the dental radiology-imaging-devices market. As individuals become more informed about the importance of regular dental check-ups and preventive care, the demand for advanced imaging technologies rises. This trend is reflected in the growing number of dental clinics adopting state-of-the-art radiology devices to enhance diagnostic accuracy. In 2025, it is estimated that the market for dental imaging devices in South Korea could reach approximately $300 million, driven by this heightened awareness. Furthermore, educational campaigns by dental associations contribute to this trend, emphasizing the role of imaging in early detection of dental issues, thereby fostering a culture of proactive dental care.

Government Initiatives and Funding

Government initiatives aimed at improving healthcare infrastructure play a crucial role in the dental radiology-imaging-devices market. In South Korea, the government has been actively promoting dental health through various programs and funding opportunities for dental clinics to upgrade their equipment. These initiatives are designed to enhance the quality of dental care and ensure that practitioners have access to the latest imaging technologies. As a result, the market is likely to experience growth, with an estimated increase of 15% in the adoption of advanced imaging devices by 2026. Furthermore, public health campaigns that encourage regular dental visits contribute to the overall demand for radiology devices, as clinics seek to provide comprehensive care to a broader patient base.

Competitive Landscape and Market Dynamics

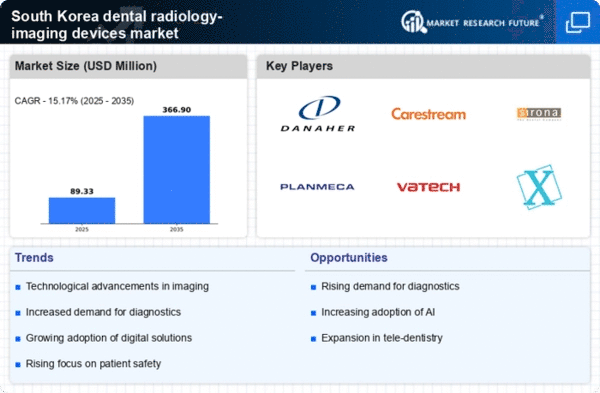

the competitive landscape of the dental radiology-imaging-devices market in South Korea features numerous players, from established manufacturers to emerging startups. This dynamic environment fosters innovation and drives advancements in imaging technologies. Companies are increasingly focusing on research and development to introduce cutting-edge products that meet the evolving needs of dental practitioners. The market is projected to witness a growth rate of 7% annually, as competition encourages the development of more efficient and cost-effective imaging solutions. Additionally, strategic partnerships and collaborations among manufacturers and dental clinics are likely to enhance market penetration, further stimulating the demand for advanced radiology devices in the dental sector.

Aging Population and Increased Dental Needs

The aging population in South Korea is a significant driver for the dental radiology-imaging-devices market. As the demographic shifts towards an older population, there is a corresponding increase in dental health issues, necessitating advanced imaging solutions for accurate diagnosis and treatment planning. By 2025, it is anticipated that over 20% of the South Korean population will be aged 65 and above, leading to a surge in demand for dental services. This demographic trend compels dental practitioners to invest in high-quality imaging devices to cater to the complex dental needs of older patients. Consequently, the market is expected to expand as dental clinics adapt to these changing patient demographics and their associated healthcare requirements.

Technological Integration in Dental Practices

The integration of advanced technologies in dental practices significantly influences the dental radiology-imaging-devices market. Innovations such as digital radiography, 3D imaging, and artificial intelligence are becoming increasingly prevalent in South Korean dental clinics. These technologies not only improve diagnostic capabilities but also enhance patient experience through reduced radiation exposure and faster imaging processes. The market is projected to grow at a CAGR of 8% from 2025 to 2030, as more practitioners recognize the benefits of adopting these advanced imaging solutions. Additionally, the seamless integration of imaging devices with practice management software allows for better patient data management, further driving the demand for sophisticated radiology devices in the dental sector.