Rising Geriatric Population

India's demographic shift towards an aging population is a critical driver for the compression therapy market. The proportion of individuals aged 60 and above is projected to reach 20% by 2050, according to the United Nations. This demographic is particularly susceptible to conditions such as venous insufficiency and lymphedema, which often require compression therapy for effective management. As the elderly population grows, the demand for specialized healthcare solutions, including compression therapy, is likely to increase. This trend suggests that the compression therapy market will experience substantial growth as healthcare providers adapt to the needs of an aging society.

Government Initiatives and Support

Government initiatives aimed at improving healthcare infrastructure and access to medical treatments are significantly influencing the compression therapy market. The Indian government has launched various schemes to enhance healthcare delivery, which includes promoting advanced medical technologies. For instance, the National Health Mission emphasizes the importance of non-communicable disease management, which encompasses the use of compression therapy. Additionally, financial support for healthcare facilities to procure advanced medical equipment is likely to boost the availability of compression therapy products. This supportive environment may lead to increased adoption rates among healthcare providers, thereby fostering growth in the compression therapy market.

Growing E-commerce and Online Retail

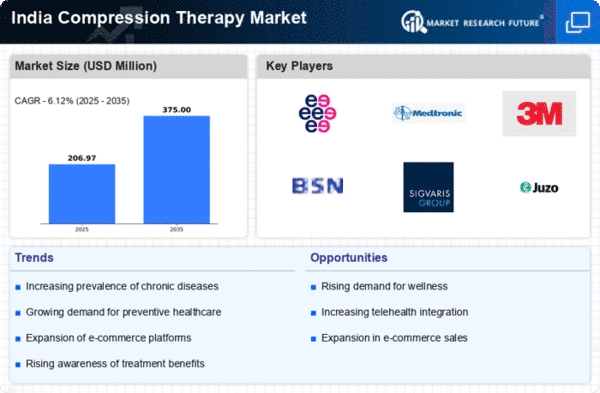

The expansion of e-commerce platforms in India is transforming the way healthcare products, including those in the compression therapy market, are distributed. With the increasing penetration of the internet and smartphone usage, consumers are more inclined to purchase medical supplies online. This shift not only enhances accessibility but also provides a wider range of options for consumers. According to industry reports, online sales of healthcare products are expected to grow at a CAGR of over 25% in the coming years. This trend indicates that e-commerce could play a pivotal role in driving the growth of the compression therapy market, as it allows for easier access to a variety of compression products.

Enhanced Focus on Preventive Healthcare

There is a growing emphasis on preventive healthcare in India, which is likely to impact the compression therapy market positively. As individuals become more health-conscious, there is an increasing recognition of the importance of preventive measures to avoid chronic conditions. Compression therapy is often recommended as a preventive strategy for individuals at risk of developing venous disorders. This shift in focus towards proactive health management is supported by various health campaigns and educational programs. Consequently, the compression therapy market may see a rise in demand as more individuals seek out preventive solutions to maintain their health.

Increasing Incidence of Chronic Diseases

The rising prevalence of chronic diseases in India, such as diabetes and cardiovascular conditions, is a notable driver for the compression therapy market. According to the Indian Council of Medical Research, approximately 77 million people in India are living with diabetes, which often leads to complications requiring compression therapy. This growing patient population necessitates effective management solutions, thereby propelling demand for compression therapy products. Furthermore, the increasing awareness among healthcare professionals regarding the benefits of compression therapy in managing these conditions is likely to enhance market growth. As healthcare systems evolve, the integration of compression therapy into treatment protocols for chronic diseases appears to be gaining traction, indicating a robust future for the compression therapy market in India.