Government Initiatives and Support

Government initiatives aimed at enhancing the agricultural and food processing sectors significantly impact the cold chain-monitoring market. The Indian government has launched various schemes to promote the development of cold storage facilities and logistics networks. For instance, the Pradhan Mantri Kisan Sampada Yojana aims to create a robust food processing ecosystem, which includes cold chain infrastructure. This initiative is expected to attract investments exceeding $1 billion in the coming years. Additionally, the government is focusing on improving rural connectivity and infrastructure, which is vital for efficient cold chain operations. Such support not only boosts the cold chain-monitoring market but also encourages private sector participation, leading to innovative solutions and technologies. As a result, the market is likely to witness substantial growth driven by these favorable policies and investments.

Rising Demand for Perishable Goods

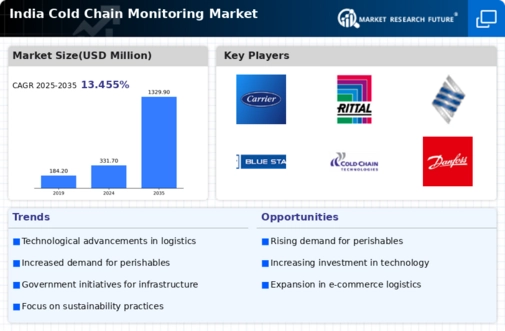

The increasing consumption of perishable goods in India is a primary driver for the cold chain-monitoring market. As urbanization accelerates, the demand for fresh produce, dairy, and meat products rises significantly. According to recent estimates, the perishable goods segment is projected to grow at a CAGR of approximately 15% over the next five years. This surge necessitates robust cold chain solutions to ensure product quality and safety during transportation and storage. The cold chain-monitoring market plays a crucial role in maintaining optimal temperature and humidity levels, thereby reducing spoilage and waste. As consumers become more health-conscious, the expectation for high-quality, fresh products further propels the need for effective cold chain management. Consequently, businesses are increasingly investing in advanced monitoring technologies to meet these demands, indicating a strong growth trajectory for the cold chain-monitoring market in India.

Technological Integration in Supply Chains

The integration of advanced technologies into supply chains is transforming the cold chain-monitoring market. Technologies such as IoT, blockchain, and AI are increasingly being adopted. Technologies such as IoT, blockchain, and AI are increasingly being adopted to enhance visibility and traceability throughout the supply chain. For instance, IoT devices enable real-time monitoring of temperature and humidity, ensuring compliance with safety standards. The cold chain-monitoring market is expected to benefit from this trend. Companies seek to leverage data analytics for better decision-making. Furthermore, the adoption of blockchain technology can enhance transparency, allowing stakeholders to track products from farm to fork. This technological evolution is likely to improve operational efficiency and reduce losses due to spoilage. As businesses recognize the value of these innovations, the cold chain-monitoring market is poised for significant growth, driven by the demand for smarter and more efficient supply chain solutions.

Increasing Consumer Awareness and Expectations

Consumer awareness regarding food safety and quality is on the rise in India, which is a significant driver for the cold chain-monitoring market. As consumers become more informed about the importance of proper food handling and storage, they demand higher standards from retailers and suppliers. This shift in consumer behavior compels businesses to adopt stringent cold chain practices to ensure product integrity. Surveys indicate that over 70% of consumers are willing to pay a premium for products that guarantee freshness and safety. Consequently, companies are investing in advanced cold chain monitoring systems to meet these expectations. This trend not only enhances customer satisfaction but also fosters brand loyalty, thereby driving growth in the cold chain-monitoring market. As the market evolves, businesses that prioritize consumer needs are likely to gain a competitive edge.

Expansion of E-commerce and Online Grocery Services

The rapid expansion of e-commerce and online grocery services in India is a pivotal driver for the cold chain-monitoring market. With the increasing preference for online shopping, especially for perishable goods, companies are compelled to establish efficient cold chain logistics to ensure timely delivery of fresh products. The e-commerce food market is projected to grow at a CAGR of around 25% in the next few years, highlighting the need for robust cold chain solutions. This growth necessitates the implementation of advanced monitoring systems to maintain product quality during transit. As online retailers strive to enhance customer experience, investments in cold chain infrastructure and technology are becoming essential. The cold chain-monitoring market is likely to thrive as businesses adapt to this evolving landscape, ensuring that they meet the demands of a growing online consumer base.