Rising Demand for Collaboration Tools

The cloud storage market in India is witnessing growth driven by the rising demand for collaboration tools among businesses. As remote work becomes more prevalent, organizations are seeking solutions that facilitate seamless collaboration among teams. Cloud storage provides a centralized platform for file sharing and real-time collaboration, which is essential for enhancing productivity. Recent surveys indicate that over 70% of Indian companies are investing in cloud-based collaboration tools to support their workforce. This trend is likely to continue, as businesses recognize the value of cloud storage in enabling efficient teamwork and communication. The integration of cloud storage with collaboration tools not only streamlines workflows but also enhances data accessibility, further solidifying its role in the modern workplace.

Growing Adoption of Digital Transformation

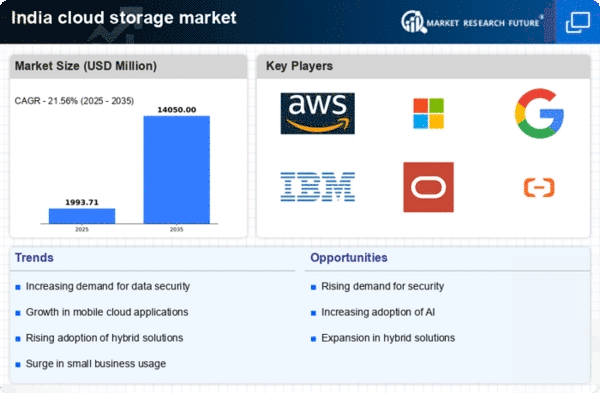

The cloud storage market in India is experiencing a surge due to the increasing adoption of digital transformation across various sectors. Organizations are migrating to cloud-based solutions to enhance operational efficiency and reduce costs. According to recent data, the Indian cloud storage market is projected to grow at a CAGR of approximately 25% from 2023 to 2028. This shift is driven by the need for businesses to access data remotely and collaborate effectively. As companies embrace digital tools, the demand for scalable and flexible cloud storage solutions is likely to rise, thereby propelling the growth of the cloud storage market. Furthermore, the push for digitalization by the Indian government through initiatives like Digital India is expected to further stimulate this trend, making cloud storage an essential component of modern business strategies.

Regulatory Compliance and Data Sovereignty

As data privacy regulations become more stringent in India, compliance is emerging as a significant driver for the cloud storage market. Organizations are increasingly required to adhere to regulations such as the Personal Data Protection Bill, which emphasizes data sovereignty and the need for secure data storage solutions. This regulatory landscape compels businesses to adopt cloud storage services that ensure compliance with local laws. The cloud storage market is likely to see growth as companies seek providers that offer robust security features and data management capabilities. Furthermore, the emphasis on data localization may lead to an increase in demand for domestic cloud storage solutions, thereby shaping the competitive landscape of the market. This trend underscores the importance of regulatory compliance in influencing cloud storage adoption.

Cost Efficiency and Operational Flexibility

Cost efficiency remains a pivotal factor driving the cloud storage market in India. Organizations are increasingly opting for cloud solutions to minimize capital expenditures associated with traditional on-premises storage systems. By leveraging cloud storage, businesses can convert fixed costs into variable costs, allowing for better financial management. A recent analysis suggests that companies can save up to 30% on storage costs by migrating to cloud-based solutions. This financial incentive, coupled with the operational flexibility offered by cloud storage, is likely to attract more businesses to adopt these solutions. The ability to scale storage resources up or down based on demand further enhances operational agility, making cloud storage an appealing choice for organizations looking to optimize their IT infrastructure.

Increased Data Generation and Storage Needs

The exponential growth of data generation in India is a critical driver for the cloud storage market. With the proliferation of IoT devices, social media, and mobile applications, organizations are producing vast amounts of data that require efficient storage solutions. Reports indicate that data generation in India is expected to reach 175 zettabytes by 2025, creating a pressing need for robust cloud storage options. Businesses are increasingly recognizing that traditional storage methods are inadequate for handling such volumes of data. Consequently, the cloud storage market is likely to benefit from this trend, as companies seek scalable solutions that can accommodate their expanding data storage needs. This shift not only enhances data accessibility but also supports analytics and business intelligence initiatives, further solidifying the role of cloud storage in the digital landscape.