Rising Security Concerns

The incidence of crime and security threats is increasing in urban and rural areas. This has led to heightened demand for surveillance solutions. The cctv camera market is experiencing growth as individuals and businesses seek to enhance their security measures. According to recent data, the market is projected to grow at a CAGR of approximately 15% over the next five years. This trend is particularly evident in metropolitan areas where property crimes have surged. The need for effective monitoring systems is driving investments in advanced cctv technologies, which are perceived as essential for safeguarding assets and ensuring public safety. As security concerns continue to escalate, the cctv camera market is likely to expand, with consumers increasingly prioritizing surveillance systems in their security budgets.

Technological Advancements

Technological innovations are playing a pivotal role in shaping the cctv camera market. The introduction of high-definition cameras, night vision capabilities, and advanced analytics is transforming the surveillance landscape. These advancements not only improve image quality but also enhance the functionality of cctv systems. For example, the integration of motion detection and facial recognition technologies is becoming increasingly common. As a result, the market is witnessing a shift towards more sophisticated surveillance solutions that offer better performance and reliability. The demand for such advanced features is expected to drive market growth, with projections indicating a potential increase in market size by 20% over the next few years. This trend underscores the importance of innovation in the cctv camera market.

Growing Adoption in Retail Sector

The retail sector is increasingly adopting CCTV cameras to enhance security and improve operational efficiency. Retailers are recognizing the value of surveillance systems in preventing theft, monitoring customer behavior, and ensuring employee safety. The cctv camera market is benefiting from this trend, with estimates suggesting that retail accounts for approximately 30% of total market revenue. As retailers invest in advanced surveillance technologies, they are also leveraging data analytics to gain insights into consumer behavior. This dual approach not only enhances security but also contributes to improved sales strategies. The growing reliance on cctv systems in the retail sector is likely to propel the overall market forward, as businesses seek to protect their assets and optimize operations.

Government Initiatives and Regulations

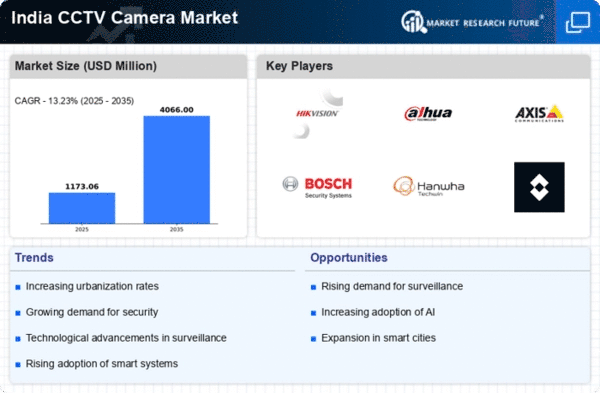

Government initiatives aimed at improving public safety and security are significantly influencing the cctv camera market. Various state and local governments are implementing policies that mandate the installation of surveillance systems in public spaces, such as transportation hubs and commercial districts. These regulations are designed to deter crime and enhance emergency response capabilities. For instance, the Smart Cities Mission in India encourages the deployment of cctv cameras as part of urban infrastructure development. This initiative is expected to boost the market, with investments projected to reach $1 billion by 2026. The alignment of government policies with market needs is fostering a conducive environment for the growth of the cctv camera market.

Increased Awareness of Surveillance Benefits

There is a growing awareness among consumers and businesses regarding the benefits of cctv cameras in enhancing security and safety. This awareness is driving demand across various sectors, including residential, commercial, and industrial. As individuals become more informed about the capabilities of modern surveillance systems, they are more inclined to invest in cctv solutions. The cctv camera market is witnessing a shift in consumer perception, with many viewing these systems as essential rather than optional. This change in mindset is expected to contribute to a steady increase in market growth, with projections indicating a potential rise in demand by 25% over the next few years. The increasing recognition of the value of surveillance is likely to sustain momentum in the cctv camera market.