Technological Integration

The integration of advanced technologies into the cctv camera market is transforming the landscape of surveillance in South Korea. Innovations such as artificial intelligence (AI), machine learning, and cloud storage are enhancing the functionality of cctv systems. These technologies enable features like facial recognition, motion detection, and remote monitoring, which are increasingly appealing to consumers. The market is witnessing a shift towards smart surveillance solutions that offer real-time analytics and improved user experience. As businesses and individuals become more tech-savvy, the demand for sophisticated cctv systems is expected to rise. This trend indicates a potential increase in market value, with estimates suggesting a growth rate of approximately 12% annually as more users adopt these advanced solutions.

Increasing Security Concerns

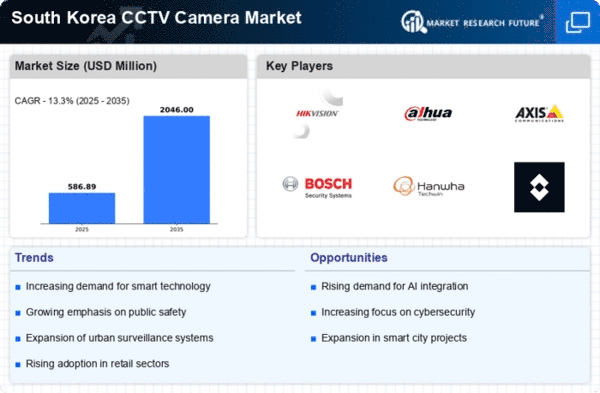

The rising concerns regarding safety and security in South Korea are driving the demand for the cctv camera market. With urbanization and population density increasing, the need for surveillance systems has become paramount. According to recent data, crime rates in urban areas have prompted both residential and commercial sectors to invest in security solutions. The cctv camera market is projected to grow as businesses and homeowners seek to deter criminal activities and enhance safety measures. This trend is further supported by government initiatives aimed at improving public safety, which may lead to increased funding for surveillance technologies. As a result, the cctv camera market is likely to experience robust growth, with an expected CAGR of around 10% over the next few years.

Rising Demand for Smart Cities

The push towards developing smart cities in South Korea is creating new opportunities for the cctv camera market. As urban areas evolve, the integration of smart technologies into city infrastructure is becoming essential. Cctv cameras play a vital role in smart city initiatives by providing real-time data for traffic management, public safety, and urban planning. The demand for interconnected surveillance systems is expected to surge as cities aim to enhance operational efficiency and improve the quality of life for residents. Market analysts suggest that the cctv camera market could see a growth rate of around 15% as municipalities invest in smart technologies to create safer and more efficient urban environments.

Government Initiatives and Funding

Government initiatives aimed at enhancing public safety and security are significantly impacting the cctv camera market. In South Korea, various programs have been launched to promote the installation of surveillance systems in public spaces, such as parks, streets, and transportation hubs. These initiatives not only aim to reduce crime but also to improve emergency response times. Funding from local and national governments is likely to bolster the cctv camera market, as municipalities invest in modern surveillance technologies. Reports indicate that public sector investments in security technologies could reach upwards of $500 million by 2026, further stimulating market growth. This government support is crucial for the expansion of the cctv camera market, as it encourages widespread adoption across different sectors.

Growing E-commerce and Retail Security Needs

The expansion of e-commerce in South Korea is influencing the cctv camera market, particularly in the retail sector. As online shopping continues to grow, brick-and-mortar stores are increasingly focusing on security to protect their assets and ensure customer safety. Retailers are investing in advanced cctv systems to monitor store activities, prevent theft, and enhance customer experience. The cctv camera market is likely to benefit from this trend, with estimates indicating a potential increase in market size by 20% over the next few years. This growth is driven by the need for comprehensive security solutions that cater to the evolving landscape of retail and consumer behavior.