Rising Awareness of Oral Health

The growing awareness of oral health among the Indian population is a significant driver for the India CBCT dental market. Educational campaigns and initiatives by both government and private sectors are emphasizing the importance of regular dental check-ups and advanced diagnostic tools. As individuals become more informed about the benefits of early detection and treatment of dental issues, the demand for advanced imaging technologies like CBCT is likely to increase. As of January 2026, this trend is reflected in the rising number of dental clinics adopting CBCT systems to enhance their diagnostic capabilities. The increased focus on preventive care is expected to further stimulate market growth, as patients seek out practices that utilize cutting-edge technology for comprehensive oral health management.

Regulatory Focus on Quality Standards

The regulatory landscape surrounding the India CBCT dental market is evolving, with a heightened focus on quality standards and safety protocols. Government bodies are implementing stricter regulations to ensure that dental imaging technologies meet specific safety and efficacy criteria. This regulatory emphasis is likely to enhance consumer confidence in CBCT technologies, thereby driving market growth. As of January 2026, compliance with these regulations is becoming a prerequisite for manufacturers and dental practices, which may lead to increased investments in quality assurance processes. The establishment of clear guidelines and standards is expected to foster a competitive environment, encouraging innovation and improvement in the quality of CBCT systems available in the market.

Technological Advancements in Imaging

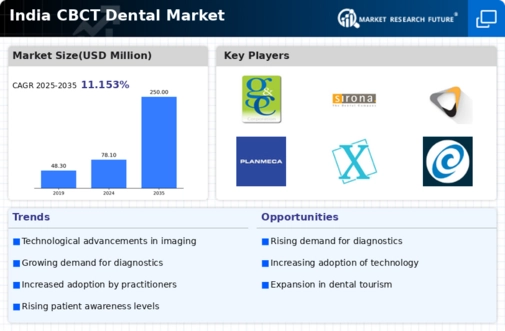

The India CBCT dental market is experiencing a surge due to rapid technological advancements in imaging techniques. Innovations such as high-resolution imaging and enhanced software capabilities are enabling dental professionals to achieve more accurate diagnoses and treatment planning. The integration of artificial intelligence in imaging analysis is also gaining traction, potentially improving the efficiency of dental practices. As of January 2026, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 12%, driven by these advancements. Furthermore, the introduction of portable CBCT units is making these technologies more accessible to a wider range of dental practitioners, thereby expanding the market reach. This trend indicates a shift towards more sophisticated imaging solutions, which could redefine standards in dental care across India.

Expansion of Dental Services in Rural Areas

The expansion of dental services into rural areas is emerging as a crucial driver for the India CBCT dental market. Government initiatives aimed at improving healthcare access in underserved regions are facilitating the establishment of dental clinics equipped with advanced imaging technologies. As of January 2026, this trend is likely to lead to a broader adoption of CBCT systems in rural practices, where the need for accurate diagnostics is paramount. The availability of CBCT technology in these areas could significantly enhance the quality of dental care provided, addressing disparities in healthcare access. This expansion not only supports the growth of the CBCT market but also contributes to overall improvements in oral health outcomes across diverse populations in India.

Growing Demand for Minimally Invasive Procedures

The increasing preference for minimally invasive dental procedures is significantly influencing the India CBCT dental market. Patients are increasingly seeking treatments that reduce recovery time and minimize discomfort, leading to a rise in the adoption of technologies that support such procedures. CBCT imaging plays a crucial role in facilitating these techniques by providing detailed three-dimensional views of dental structures, which aids in precise treatment planning. As of January 2026, the market is witnessing a notable increase in the utilization of CBCT for procedures like dental implants and orthodontics, which are less invasive compared to traditional methods. This growing demand is likely to propel the market further, as dental practitioners adopt CBCT technology to meet patient expectations and improve clinical outcomes.