Expansion of the Plastics Industry

The India Carbon Black Market is significantly influenced by the expansion of the plastics sector. Carbon black is widely used as a reinforcing agent in various plastic products, enhancing their strength and durability. With the plastics industry projected to grow at a compound annual growth rate of approximately 8% over the next few years, the demand for carbon black is expected to follow suit. This growth is driven by increasing applications in packaging, consumer goods, and construction materials. As manufacturers seek to improve the performance characteristics of their plastic products, the reliance on carbon black is likely to intensify, thereby bolstering the India Carbon Black Market.

Increasing Environmental Regulations

The India Carbon Black Market is being shaped by the increasing environmental regulations aimed at reducing emissions and promoting sustainable practices. As industries face stricter compliance requirements, there is a growing emphasis on producing carbon black through cleaner technologies. This shift is likely to drive innovation within the industry, as manufacturers invest in research and development to create eco-friendly carbon black alternatives. Furthermore, the demand for sustainable products is rising among consumers, prompting companies to adopt greener practices. This evolving landscape indicates that the India Carbon Black Market may experience a transformation, aligning with global sustainability trends while meeting regulatory standards.

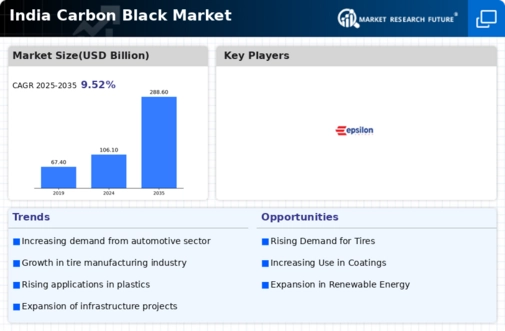

Rising Demand from Tire Manufacturing

The India Carbon Black Market is experiencing a notable surge in demand, primarily driven by the tire manufacturing sector. Tires account for a substantial portion of carbon black consumption, with estimates suggesting that around 70% of carbon black produced is utilized in tire production. As the automotive industry expands, particularly with the increasing production of passenger and commercial vehicles, the demand for high-performance tires is likely to rise. This trend is further supported by the growing emphasis on safety and durability in tire design, which necessitates the use of high-quality carbon black. Consequently, the India Carbon Black Market is poised for growth, as manufacturers strive to meet the evolving needs of the tire sector.

Growth in the Coatings and Inks Sector

The India Carbon Black Market is also witnessing growth due to the rising demand from the coatings and inks sector. Carbon black serves as a vital pigment and reinforcing agent in various coatings, providing color and enhancing durability. The coatings industry is projected to grow at a steady pace, driven by increasing applications in automotive, industrial, and decorative coatings. As manufacturers seek to improve the performance and aesthetic qualities of their products, the incorporation of carbon black is likely to become more prevalent. This trend suggests a promising future for the India Carbon Black Market, as it adapts to the evolving needs of the coatings and inks market.

Infrastructure Development Initiatives

The India Carbon Black Market is benefiting from the ongoing infrastructure development initiatives across the country. The government's focus on enhancing transportation networks, urban development, and housing projects is driving demand for construction materials that incorporate carbon black. For instance, carbon black is utilized in the production of asphalt and concrete, which are essential for road construction and maintenance. With the Indian government allocating substantial budgets for infrastructure projects, the demand for carbon black is anticipated to increase. This trend indicates a positive outlook for the India Carbon Black Market, as it aligns with national development goals and the need for sustainable construction practices.