Rising Cybersecurity Concerns

The biometric banking market in India is experiencing growth due to escalating concerns regarding cybersecurity. Financial institutions are increasingly targeted by cybercriminals, leading to a heightened demand for secure authentication methods. Biometric solutions, such as fingerprint and facial recognition, provide a robust defense against unauthorized access. According to recent data, the financial sector in India has reported a 30% increase in cyberattacks over the past year, prompting banks to invest in advanced security measures. This trend indicates a shift towards biometric technologies, which are perceived as more secure than traditional methods. As a result, the biometric banking market is likely to expand as institutions prioritize safeguarding customer data and maintaining trust. The integration of biometric systems not only enhances security but also streamlines the user experience, making it a compelling choice for banks in India.

Government Initiatives and Support

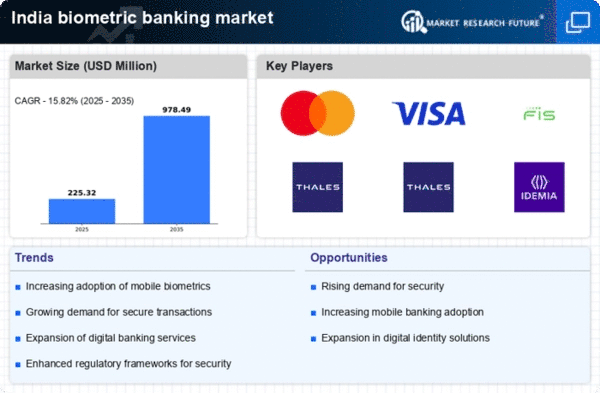

Government initiatives play a crucial role in shaping the biometric banking market in India. The Indian government has been actively promoting digital banking and financial inclusion, which has led to increased investments in biometric technologies. Programs aimed at enhancing the security of financial transactions are encouraging banks to adopt biometric solutions. For example, the Digital India initiative aims to transform India into a digitally empowered society, which includes the implementation of biometric authentication in banking services. As a result, the biometric banking market is expected to witness substantial growth, with projections indicating a CAGR of 25% over the next five years. This supportive regulatory environment is likely to foster innovation and encourage financial institutions to explore new biometric applications, further solidifying the market's expansion.

Consumer Demand for Enhanced Security

The biometric banking market is also driven by consumer demand for enhanced security in financial transactions. As customers become more aware of the risks associated with traditional banking methods, they are increasingly seeking secure alternatives. Biometric authentication offers a unique solution by providing a higher level of security through unique biological traits. Surveys indicate that approximately 70% of Indian consumers prefer biometric methods over traditional passwords for banking transactions. This shift in consumer preference is prompting banks to invest in biometric technologies to meet customer expectations. The growing awareness of identity theft and fraud is likely to further propel the adoption of biometric solutions in the banking sector. Consequently, the biometric banking market is poised for growth as financial institutions respond to the evolving demands of their customers.

Integration with Mobile Banking Solutions

The integration of biometric authentication with mobile banking solutions is emerging as a key driver for the biometric banking market in India. With the increasing penetration of smartphones and mobile internet, consumers are seeking convenient and secure ways to access their banking services. Biometric features, such as fingerprint scanning and facial recognition, are being incorporated into mobile banking applications to enhance security and user experience. As of November 2025, it is estimated that over 60% of banking transactions in India are conducted via mobile devices, highlighting the importance of secure authentication methods. This trend suggests that financial institutions are likely to prioritize the development of biometric-enabled mobile banking solutions to cater to the growing demand. The convergence of mobile technology and biometric systems is expected to significantly contribute to the expansion of the biometric banking market.

Technological Advancements in Biometric Systems

The biometric banking market is significantly influenced by rapid technological advancements in biometric systems. Innovations in artificial intelligence and machine learning are enhancing the accuracy and efficiency of biometric authentication methods. For instance, the introduction of 3D facial recognition technology has improved the reliability of identity verification processes. As of November 2025, the market for biometric solutions in India is projected to reach $1 billion, driven by these technological improvements. Financial institutions are increasingly adopting these advanced systems to stay competitive and meet customer expectations for seamless banking experiences. Furthermore, the integration of biometric systems with mobile banking applications is likely to facilitate greater user adoption, as customers seek convenient and secure ways to manage their finances. This trend suggests a promising future for the biometric banking market as technology continues to evolve.