Rising Cybersecurity Threats

The biometric banking market is significantly influenced by the rising threats of cybercrime. As financial institutions face increasing attacks, the need for robust security measures becomes paramount. Biometric authentication offers a unique solution, as it is inherently more secure than traditional methods like passwords. In 2025, it is estimated that cybercrime will cost the global economy over $10 trillion annually, prompting banks to adopt biometric solutions to protect sensitive customer data. The biometric banking market is responding to this urgent need, with many institutions prioritizing investments in biometric technologies to mitigate risks and enhance customer trust.

Increased Investment in Fintech Innovations

The biometric banking market is witnessing increased investment in fintech innovations, which are driving the adoption of biometric technologies. Venture capital funding for fintech companies has surged, with investments reaching approximately $50 billion in 2025. This influx of capital is enabling the development of cutting-edge biometric solutions that enhance security and user experience. As fintech companies collaborate with traditional banks, the biometric banking market is expected to expand rapidly, offering consumers more secure and efficient banking options. This trend indicates a promising future for biometric technologies in the financial sector.

Consumer Preference for Seamless Transactions

The biometric banking market is benefiting from a growing consumer preference for seamless and convenient transaction methods. As customers increasingly seek quick and efficient banking experiences, biometric solutions provide a compelling alternative to traditional authentication methods. Surveys indicate that over 70% of consumers prefer biometric authentication for its speed and ease of use. This shift in consumer behavior is driving banks to adopt biometric technologies, thereby enhancing customer satisfaction and loyalty. The biometric banking market is thus adapting to these changing preferences, positioning itself as a leader in providing innovative solutions that cater to modern banking needs.

Technological Advancements in Biometric Systems

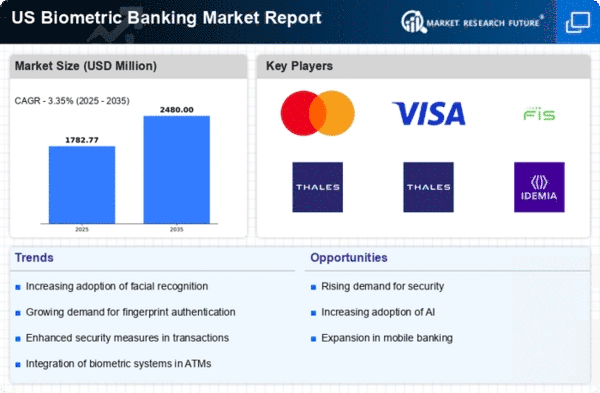

The biometric banking market is experiencing a surge due to rapid technological advancements in biometric systems. Innovations in fingerprint recognition, facial recognition, and iris scanning are enhancing the accuracy and efficiency of these systems. As of 2025, the market is projected to reach approximately $5 billion, driven by the integration of artificial intelligence and machine learning. These technologies not only improve security but also streamline customer experiences, making transactions faster and more reliable. Financial institutions are increasingly investing in these advanced biometric solutions to stay competitive and meet consumer expectations. The biometric banking market is thus poised for significant growth as these technologies become more accessible and affordable.

Regulatory Frameworks Supporting Biometric Solutions

The biometric banking market is being shaped by evolving regulatory frameworks that support the implementation of biometric solutions. Governments and regulatory bodies are recognizing the importance of secure banking practices and are encouraging the adoption of biometric technologies. In 2025, it is anticipated that regulatory compliance costs for financial institutions will exceed $200 billion, prompting banks to invest in more secure systems. The biometric banking market is likely to benefit from these supportive regulations, as they create a conducive environment for the growth and integration of biometric solutions in banking operations.