Rising Cybersecurity Threats

The biometric banking market in Germany is experiencing growth due to the increasing prevalence of cybersecurity threats. Financial institutions are under constant pressure to protect sensitive customer data from breaches and fraud. As traditional security measures become less effective, banks are turning to biometric solutions, which offer enhanced security through unique physical traits. In 2025, it is estimated that the biometric banking market will grow by approximately 20% as institutions invest in advanced technologies to safeguard their operations. This shift not only addresses security concerns but also builds customer trust, which is crucial in a competitive landscape.

Consumer Demand for Convenience

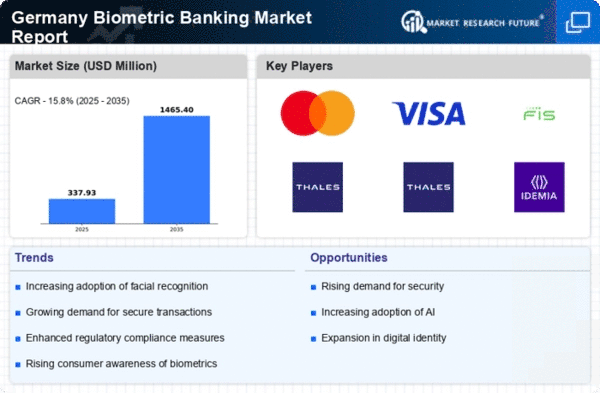

In the context of the biometric banking market, there is a notable shift in consumer preferences towards convenience and speed in banking transactions. German consumers increasingly favor seamless experiences, prompting banks to adopt biometric solutions that facilitate quick and secure access to accounts. The market is projected to witness a growth rate of around 15% as more institutions implement fingerprint and facial recognition technologies. This trend reflects a broader societal move towards digitalization, where customers expect efficient services without compromising security. The integration of biometrics aligns with these expectations, enhancing user satisfaction.

Growing Awareness of Identity Theft Risks

The biometric banking market is also driven by a growing awareness of identity theft risks among consumers and financial institutions. In Germany, incidents of identity theft have prompted banks to seek more secure authentication methods. As a result, the market is projected to grow by 14% as institutions adopt biometric solutions to mitigate these risks. Consumers are increasingly aware of the vulnerabilities associated with traditional passwords and PINs, leading to a demand for more secure alternatives. This heightened awareness is likely to propel the adoption of biometric technologies, reinforcing their role in the banking sector.

Regulatory Support for Biometric Solutions

Regulatory frameworks in Germany are increasingly supportive of biometric solutions in the banking sector. The biometric banking market benefits from guidelines that encourage the adoption of secure authentication methods while ensuring compliance with data protection laws. As regulations evolve, banks are more inclined to invest in biometric technologies, which are perceived as compliant and secure. This regulatory support is expected to drive market growth by approximately 12% in the coming years, as institutions seek to align with legal requirements while enhancing their security measures. The interplay between regulation and technology is crucial for the market's development.

Technological Advancements in Biometric Systems

The biometric banking market is significantly influenced by rapid technological advancements in biometric systems. Innovations in artificial intelligence and machine learning are enhancing the accuracy and reliability of biometric authentication methods. In Germany, the market is expected to expand by 18% as banks leverage these technologies to improve user experience and security. Enhanced biometric systems not only reduce the risk of fraud but also streamline the authentication process, making it more user-friendly. As technology continues to evolve, the adoption of sophisticated biometric solutions is likely to become a standard practice in the banking sector.