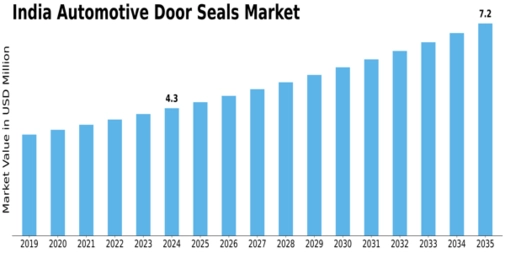

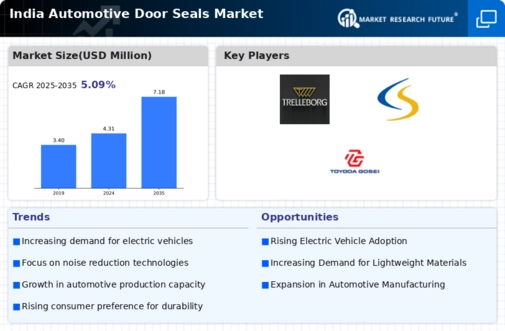

India Automotive Door Seals Size

India Automotive Door Seals Market Growth Projections and Opportunities

In recent years, the automotive industry has experienced substantial growth, a phenomenon fueled in no small part by the soaring demand in the Automotive Door Seals market. The proliferation of vehicles on the road, especially passenger vehicles, has emerged as a key contributor to the expansion and evolution of the Automotive Door Seals Market. The adoption of new technologies in the industry promises to further elevate the growth trajectory of the Automotive Door Seals market. Europe is poised to take the lead in the automotive door seal market, driven by the presence of numerous major market players. The region's robust automotive industry and ongoing technological advancements position it as a frontrunner for significant growth in the Automotive Door Seals market. However, it is not the sole contender; Asia-Pacific and North America also emerge as prominent regions, propelled by the escalating demand within their respective automotive sectors. Examining the material landscape, the rubber segment stands out as the dominant force in the automotive seal market, claiming a substantial 40% market share in 2015 and sustaining a commendable Compound Annual Growth Rate (CAGR) of 4.28%. The sponge segment, based on material, captures a market share of 25%, experiencing a robust CAGR of 4.85%. Meanwhile, the others segment, encompassing various materials, secures a 35% market share in 2015, boasting the highest CAGR of 5.25%. Original Equipment Manufacturers (OEMs) play a pivotal role in the automotive seal market, representing companies that produce parts and automotive components, which may subsequently be marketed by another manufacturer. The OEM segment takes the lead, commanding a substantial 70% market share in 2015. On the flip side, the aftermarket segment in the automotive industry operates as a secondary market, dealing with distribution, manufacturing, and accessories post the sale of automobiles by OEMs. While the aftermarket segment holds a comparatively smaller share at 30% in 2015, it remains an integral component of the automotive seal market ecosystem. As the automotive industry continues to evolve, several trends and opportunities are anticipated to shape the future of the Automotive Door Seals market. The rising demand for vehicles, advancements in automotive technologies, and a renewed focus on sustainability are expected to fuel further growth. The market is likely to witness innovative solutions, driven by ongoing research and development activities, setting the stage for a dynamic and competitive landscape. The Automotive Door Seals market stands at the intersection of technological innovation, regional market dynamics, and material trends. With Europe leading the charge, the market is set for substantial growth, driven by a confluence of factors. As OEMs and the aftermarket collaborate to meet the evolving needs of the automotive industry, the road ahead for the Automotive Door Seals market promises to be one marked by resilience, innovation, and strategic advancements.

Leave a Comment