Market Analysis

In-depth Analysis of India Automotive Door Seals Market Industry Landscape

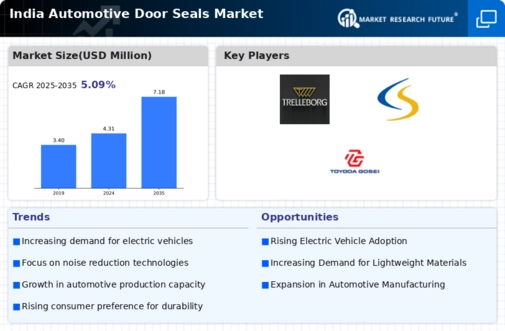

The Indian automotive sector is experiencing a transformative surge, driven by evolving consumer preferences, technological advancements, and an increasing emphasis on vehicle comfort and efficiency. Within this dynamic landscape, the demand for Automotive Door Seals has become a notable focal point, reflecting a broader shift in consumer expectations and industry trends. This comprehensive exploration delves into the factors fueling the demand for Automotive Door Seals in the Indian automotive market, shedding light on key drivers, market dynamics, and future trajectories. The Indian automotive market is witnessing a pronounced shift in consumer preferences, with an increasing focus on vehicle comfort and advanced features. As consumers become more discerning, factors such as smooth rides, reduced noise levels, and enhanced overall driving experiences are gaining prominence. In this context, Automotive Door Seals play a pivotal role in ensuring a quiet and comfortable interior, shielding passengers from external vibrations and noise. Comfort features are emerging as a key differentiator in the Indian automotive landscape, influencing purchasing decisions across vehicle segments. Automotive Door Seals, once considered basic components, are now recognized for their impact on overall cabin comfort. The surge in demand for vehicles equipped with advanced comfort features is inherently linked to the growing appreciation of the role played by door seals in creating a tranquil and pleasant driving environment. Technological advancements in Automotive Door Seals are aligning with the changing automotive landscape in India. Modern door seals go beyond their traditional role of preventing noise and vibrations; they now contribute to enhanced safety, weather resistance, and overall vehicle efficiency. The integration of advanced materials and manufacturing processes has resulted in door seals that not only meet stringent quality standards but also offer durability and longevity. Government regulations and safety standards are exerting a considerable influence on the automotive industry in India. As safety becomes a paramount concern, vehicle manufacturers are compelled to adopt advanced safety features, including robust door sealing systems. Compliance with safety norms has become a driving force behind the integration of high-quality Automotive Door Seals in vehicles, contributing to increased demand. Original Equipment Manufacturers (OEMs) are at the forefront of embracing technological innovations in response to the evolving market dynamics. The partnership between OEMs and door seal manufacturers has become instrumental in introducing cutting-edge solutions that cater to the demands of modern Indian consumers. This collaboration is driving the adoption of innovative door seal designs and materials, enhancing the overall driving experience. India's rapid urbanization and infrastructure development are shaping the automotive landscape, influencing the demand for vehicles equipped with advanced features. As urban areas expand, the need for vehicles capable of navigating diverse and challenging driving conditions becomes pronounced. Automotive Door Seals, designed to provide effective insulation against dust, pollutants, and noise, are increasingly becoming a sought-after feature in vehicles across urban India. Looking ahead, the demand for Automotive Door Seals in the Indian market is poised for sustained growth. As consumer expectations continue to evolve and the automotive industry undergoes technological advancements, door seals will remain integral to the overall vehicle design. The focus on creating a comfortable and safe driving environment is expected to drive further innovations in door seal technology, with market players gearing up to meet the evolving demands of Indian consumers. The demand for Automotive Door Seals in the Indian market reflects a multifaceted interplay of consumer preferences, technological advancements, and regulatory imperatives. As India's automotive landscape continues to transform, door seals will remain a crucial component, contributing not only to the comfort and safety of vehicles but also to the overall driving experience embraced by Indian consumers.

Leave a Comment