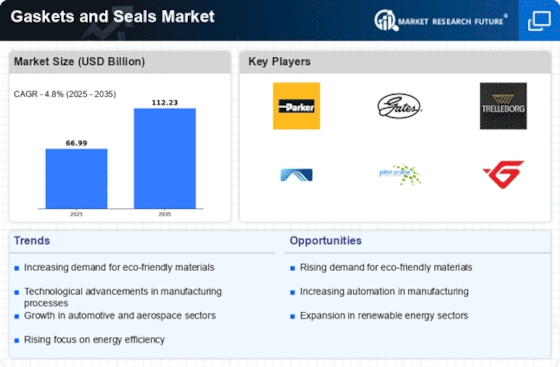

Growing Focus on Energy Efficiency

The increasing emphasis on energy efficiency across industries is significantly influencing the Gaskets And Seals Market. Companies are actively seeking solutions that minimize energy loss and enhance system performance. Gaskets and seals play a crucial role in ensuring optimal energy efficiency by preventing leaks and maintaining pressure in various applications. In 2025, the market for energy-efficient sealing solutions is expected to grow by 6%, driven by regulatory pressures and consumer demand for sustainable practices. This focus on energy efficiency not only aligns with environmental goals but also presents a lucrative opportunity for manufacturers to innovate and offer products that meet these emerging requirements.

Rising Demand in Automotive Sector

The automotive sector is experiencing a notable surge in demand for gaskets and seals, driven by the increasing production of vehicles. As manufacturers strive for enhanced performance and efficiency, the Gaskets And Seals Market is witnessing a corresponding rise in the need for high-quality sealing solutions. In 2025, the automotive segment accounted for approximately 30% of the total market share, indicating a robust growth trajectory. This trend is likely to continue as electric vehicles and hybrid models gain traction, necessitating advanced sealing technologies to manage higher pressures and temperatures. Furthermore, the push for lightweight materials in automotive design is expected to further propel the demand for innovative gasket and seal solutions, thereby reinforcing the industry's growth prospects.

Regulatory Standards and Compliance

The Gaskets And Seals Market is increasingly influenced by stringent regulatory standards and compliance requirements across various sectors. Industries such as automotive, aerospace, and pharmaceuticals are subject to rigorous regulations that mandate the use of high-quality sealing solutions to ensure safety and reliability. As these regulations evolve, manufacturers are compelled to adapt their product offerings to meet compliance standards. In 2025, the impact of regulatory compliance is projected to drive a market growth of approximately 4%, as companies prioritize the adoption of gaskets and seals that adhere to these standards. This trend underscores the importance of quality assurance and the need for manufacturers to invest in certifications and testing to remain competitive in the market.

Expansion in Industrial Applications

The industrial sector is increasingly adopting gaskets and seals across various applications, including manufacturing, oil and gas, and chemical processing. This expansion is primarily attributed to the need for reliable sealing solutions that can withstand harsh operating conditions. The Gaskets And Seals Market is projected to grow significantly as industries seek to enhance operational efficiency and reduce maintenance costs. In 2025, industrial applications represented around 25% of the market, reflecting a strong demand for durable and high-performance sealing products. As industries continue to evolve and modernize, the requirement for advanced gaskets and seals that can meet stringent performance standards is expected to drive further growth in this segment.

Technological Innovations in Material Science

Technological advancements in material science are playing a pivotal role in shaping the Gaskets And Seals Market. Innovations such as the development of advanced elastomers and composite materials are enhancing the performance characteristics of gaskets and seals. These materials offer improved resistance to chemicals, temperature fluctuations, and mechanical stress, thereby expanding their applicability across various sectors. In 2025, the introduction of new materials is anticipated to contribute to a market growth rate of approximately 5% annually. This trend suggests that manufacturers who invest in research and development to create cutting-edge sealing solutions will likely gain a competitive edge in the market, catering to the evolving needs of diverse industries.