Rising Healthcare Expenditure

The increase in healthcare expenditure in India is a significant driver for the asthma copd-drugs market. With the government's commitment to improving healthcare infrastructure and access, spending on health services has risen substantially. Reports indicate that healthcare expenditure as a % of GDP has increased from 3.5% to approximately 4.5% in recent years. This trend suggests a growing recognition of the importance of addressing chronic diseases, including asthma and COPD. As more funds are allocated to respiratory health, the availability of asthma copd-drugs is likely to improve, facilitating better management of these conditions. Enhanced insurance coverage and reimbursement policies may further support this growth, making treatments more accessible to patients.

Increased Awareness and Education

The growing awareness and education regarding respiratory diseases are pivotal in shaping the asthma copd-drugs market in India. Public health campaigns and educational initiatives by both governmental and non-governmental organizations have led to a better understanding of asthma and COPD among the population. This heightened awareness encourages individuals to seek medical advice and treatment, thereby increasing the demand for asthma copd-drugs. Additionally, healthcare professionals are being trained to recognize and manage these conditions more effectively, which may lead to earlier diagnosis and treatment. As awareness continues to rise, the market is expected to benefit from an influx of patients seeking appropriate therapies.

Advancements in Pharmaceutical Research

Ongoing advancements in pharmaceutical research are significantly influencing the asthma copd-drugs market in India. The development of novel drug formulations and delivery systems, such as inhalers and nebulizers, enhances the efficacy of treatments for asthma and COPD. Research institutions and pharmaceutical companies are increasingly investing in clinical trials to explore new therapeutic agents, including biologics and small molecules. This investment is expected to yield innovative solutions that address unmet medical needs, potentially increasing market share. Furthermore, the introduction of generic drugs following patent expirations is likely to make treatments more accessible and affordable, thereby expanding the market reach and improving patient outcomes.

Regulatory Support and Policy Framework

The regulatory environment in India is evolving to support the asthma copd-drugs market. The government has implemented policies aimed at streamlining drug approval processes and enhancing the quality of medications available in the market. Initiatives to promote research and development in respiratory therapies are also gaining traction, potentially leading to a more robust pipeline of innovative treatments. Furthermore, the establishment of guidelines for the management of asthma and COPD by health authorities is likely to standardize treatment protocols, encouraging the use of effective drugs. This supportive regulatory framework may foster a conducive environment for market growth, attracting investments and encouraging pharmaceutical companies to develop new products.

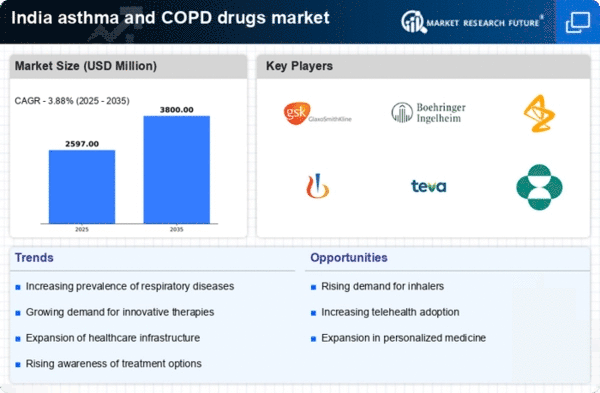

Increasing Prevalence of Respiratory Diseases

The rising incidence of respiratory diseases, particularly asthma and COPD, is a crucial driver for the asthma copd-drugs market in India. According to recent health surveys, approximately 15-20% of the Indian population suffers from asthma, while COPD affects around 5-10% of adults. This growing patient base necessitates the development and availability of effective medications, thereby propelling market growth. The increasing urbanization and pollution levels in cities further exacerbate respiratory conditions, leading to a higher demand for asthma copd-drugs. As healthcare providers seek to address these challenges, the market is likely to expand, with a focus on innovative therapies and treatment options tailored to the needs of the Indian population.