Rising Healthcare Expenditure

The increase in healthcare expenditure in South Korea is a significant driver for the asthma copd-drugs market. With the government allocating more resources to healthcare, spending on respiratory medications is expected to rise. In 2025, healthcare spending is projected to reach approximately $200 billion, with a notable portion directed towards chronic respiratory diseases. This trend indicates a growing recognition of the importance of managing asthma and COPD effectively. The asthma copd-drugs market stands to benefit from this increased funding, as it allows for better access to medications and improved healthcare services for patients. Consequently, this financial commitment is likely to enhance treatment adherence and overall patient outcomes.

Advancements in Drug Development

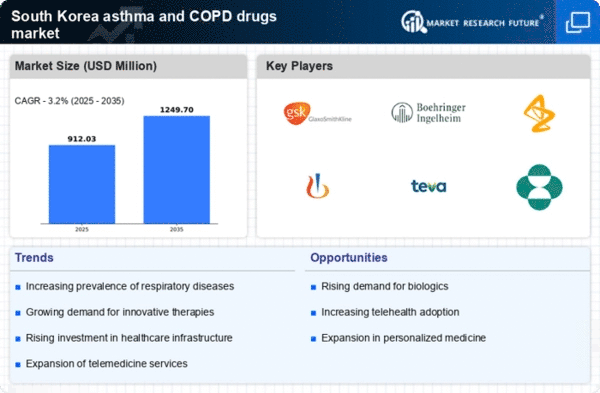

Innovations in drug development are significantly influencing the asthma copd-drugs market. The introduction of biologics and targeted therapies has transformed treatment paradigms, offering new hope for patients with severe asthma and COPD. Recent advancements have led to the approval of several novel medications that demonstrate improved efficacy and safety profiles. The asthma copd-drugs market is witnessing a surge in research and development investments, with pharmaceutical companies focusing on personalized medicine approaches. This shift not only enhances treatment options but also aligns with the increasing demand for tailored therapies among patients. As a result, the market is expected to expand, with a projected growth rate of around 8% annually over the next five years.

Regulatory Support for Drug Approvals

Regulatory support for the approval of new asthma and COPD medications is a crucial driver for the market. The South Korean government has streamlined the drug approval process, facilitating faster access to innovative therapies. This regulatory environment encourages pharmaceutical companies to invest in research and development, knowing that their products can reach the market more efficiently. The asthma copd-drugs market benefits from this supportive framework, as it fosters competition and drives the introduction of new treatment options. As a result, patients gain access to a wider array of effective medications, which is likely to enhance treatment outcomes and overall market growth.

Growing Prevalence of Respiratory Diseases

The increasing incidence of respiratory diseases in South Korea is a primary driver for the asthma copd-drugs market. According to health statistics, approximately 3.5 million individuals are diagnosed with asthma and COPD, leading to a heightened demand for effective treatment options. This trend is likely to continue as urbanization and pollution levels rise, exacerbating respiratory conditions. The asthma copd-drugs market is responding to this growing need by developing new medications and therapies aimed at improving patient outcomes. Furthermore, the aging population in South Korea, which is projected to reach 20% by 2025, is expected to contribute significantly to the prevalence of these diseases, thereby driving market growth.

Increased Awareness and Screening Programs

There is a growing awareness of asthma and COPD among the South Korean population, driven by public health campaigns and screening programs. These initiatives aim to educate individuals about the symptoms and risks associated with respiratory diseases, leading to earlier diagnosis and treatment. The asthma copd-drugs market is likely to experience growth as more patients seek medical attention and require pharmacological interventions. Furthermore, the implementation of national screening programs has resulted in a higher detection rate of undiagnosed cases, which is expected to further boost the demand for asthma and COPD medications. This proactive approach to respiratory health is anticipated to contribute positively to market dynamics.