Advancements in Drug Delivery Systems

Innovations in drug delivery systems are transforming the landscape of the Asthma and COPD Drugs Market. The emergence of smart inhalers, nebulizers, and other advanced delivery mechanisms enhances the efficacy of medications while improving patient compliance. For instance, smart inhalers equipped with digital technology can track usage patterns and provide feedback to patients, thereby promoting adherence to prescribed regimens. This technological evolution not only optimizes therapeutic outcomes but also fosters a more engaged patient population. As these advanced delivery systems gain traction, they are expected to significantly influence the market dynamics, driving demand for new and existing asthma and COPD medications.

Rising Awareness and Education Initiatives

Enhanced awareness and education initiatives regarding asthma and COPD are pivotal in shaping the Asthma and COPD Drugs Market. Public health campaigns and educational programs are increasingly informing patients about the importance of early diagnosis and effective management of these conditions. This heightened awareness is likely to lead to increased diagnosis rates and, consequently, a greater demand for asthma and COPD medications.

Furthermore, healthcare providers are becoming more proactive in discussing treatment options with patients, which may result in improved adherence to prescribed therapies. As awareness continues to grow, the market is expected to expand, driven by an informed patient population seeking effective treatment solutions.

Regulatory Support for Innovative Therapies

Regulatory bodies are playing a crucial role in fostering innovation within the Asthma and COPD Drugs Market. Initiatives aimed at expediting the approval process for new therapies, particularly those addressing unmet medical needs, are becoming more prevalent. For instance, fast-track designations and priority review pathways are being utilized to bring novel treatments to market more swiftly.

This supportive regulatory environment encourages pharmaceutical companies to invest in research and development, knowing that their innovative solutions may receive timely approval. As a result, the Asthma and COPD Drugs Market is likely to benefit from a steady influx of new therapies, enhancing treatment options for patients.

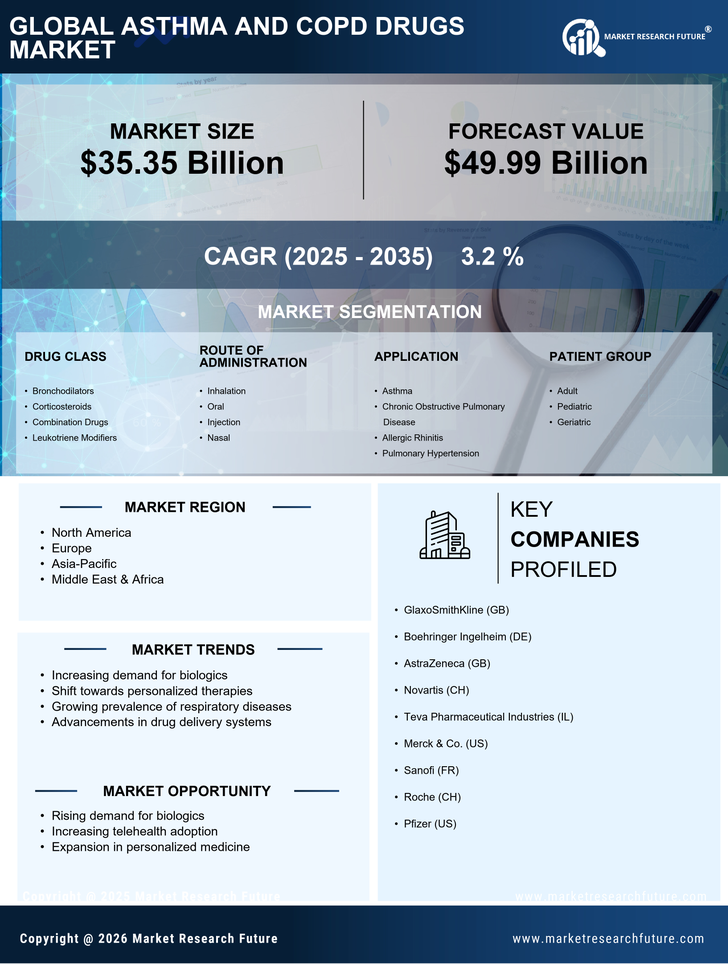

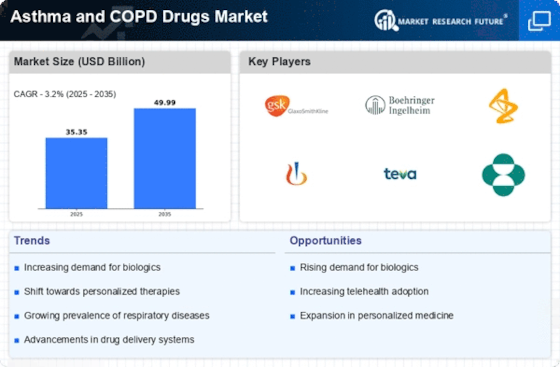

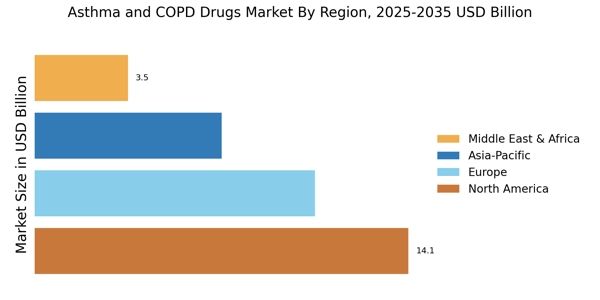

Increasing Prevalence of Respiratory Diseases

The rising incidence of asthma and chronic obstructive pulmonary disease (COPD) is a primary driver for the Asthma and COPD Drugs Market. According to recent estimates, approximately 300 million individuals suffer from asthma, while COPD affects around 250 million people worldwide. This growing patient population necessitates the development and availability of effective therapeutic options. As awareness of respiratory diseases increases, healthcare systems are compelled to allocate more resources towards managing these conditions. Consequently, pharmaceutical companies are investing heavily in research and development to create innovative drugs that cater to the needs of this expanding demographic. This trend is likely to continue, further propelling the growth of the Asthma and COPD Drugs Market.

Growing Investment in Respiratory Drug Research

The Asthma and COPD Drugs Market is witnessing a surge in investment directed towards respiratory drug research. Pharmaceutical companies are increasingly recognizing the potential for lucrative returns in this sector, leading to heightened funding for clinical trials and drug development. In recent years, the market has seen a proliferation of novel therapies, including biologics and small molecules, aimed at addressing unmet medical needs.

This influx of capital is likely to accelerate the pace of innovation, resulting in a broader array of treatment options for patients. As a consequence, the Asthma and COPD Drugs Market is poised for substantial growth, driven by the continuous introduction of new therapies.