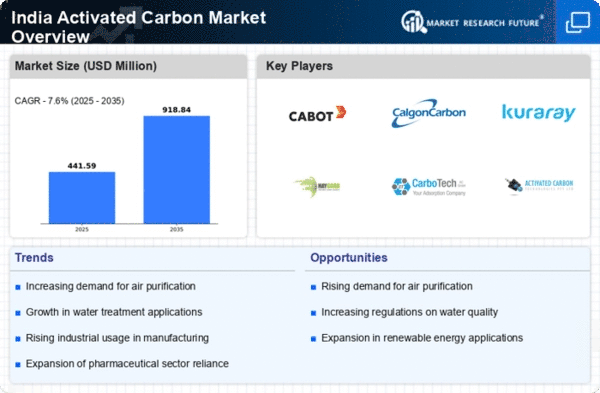

The activated carbon market in India is characterized by a dynamic competitive landscape, driven by increasing demand across various sectors such as water treatment, air purification, and industrial processes. Key players are actively positioning themselves through strategic initiatives aimed at enhancing their market presence and operational efficiency. Companies like Calgon Carbon Corporation (US) and Kuraray Co Ltd (JP) are focusing on innovation and sustainability, which appear to be pivotal in shaping their competitive strategies. This collective emphasis on advanced technologies and eco-friendly solutions is likely to redefine the market dynamics, fostering a more competitive environment.In terms of business tactics, localizing manufacturing and optimizing supply chains are becoming increasingly critical. The market structure is moderately fragmented, with several players vying for market share. However, the influence of major companies such as Ingevity Corporation (US) and Haycarb PLC (LK) is substantial, as they leverage their extensive networks and resources to enhance operational capabilities. This competitive structure suggests that while there is room for smaller players, the dominance of established firms is likely to persist, shaping the overall market trajectory.

In October Calgon Carbon Corporation (US) announced the launch of a new line of sustainable activated carbon products designed specifically for the water treatment sector. This strategic move underscores the company's commitment to environmental sustainability and positions it favorably in a market increasingly driven by eco-conscious consumers. The introduction of these products is expected to enhance Calgon's competitive edge, as it aligns with the growing regulatory pressures for sustainable practices in water management.

In September Kuraray Co Ltd (JP) expanded its production capacity in India by investing approximately $10 million in a new facility. This expansion is indicative of Kuraray's strategy to strengthen its foothold in the region, catering to the rising demand for activated carbon. By increasing local production capabilities, Kuraray not only reduces lead times but also enhances its ability to respond to market fluctuations, thereby solidifying its competitive position.

In August Ingevity Corporation (US) entered into a strategic partnership with a leading Indian water treatment company to co-develop advanced filtration solutions. This collaboration is likely to leverage Ingevity's technological expertise and the local partner's market knowledge, creating a synergistic effect that could lead to innovative product offerings. Such partnerships are becoming increasingly vital in the current landscape, as they enable companies to pool resources and enhance their competitive capabilities.

As of November the activated carbon market is witnessing trends that emphasize digitalization, sustainability, and the integration of artificial intelligence in production processes. Strategic alliances are playing a crucial role in shaping the competitive landscape, allowing companies to innovate and adapt to changing market demands. The shift from price-based competition to a focus on technological advancement and supply chain reliability is becoming evident. Moving forward, competitive differentiation will likely hinge on the ability to innovate and deliver sustainable solutions, positioning companies to thrive in an evolving market.