Increased Focus on Industry 4.0

The 5G IoT Market in India is significantly influenced by the increasing focus on Industry 4.0, which emphasizes automation and data exchange in manufacturing technologies. As industries adopt IoT solutions to enhance productivity and efficiency, the demand for 5G connectivity is expected to rise. The ability of 5G networks to support a massive number of connected devices with low latency is crucial for real-time monitoring and control in manufacturing processes. Reports suggest that the Indian manufacturing sector could see a growth of up to 30% by 2025, driven by the adoption of smart manufacturing practices. This shift towards Industry 4.0 is likely to create substantial opportunities for the 5g iot market, as companies seek to implement advanced technologies that require high-speed connectivity and reliable data transmission.

Growth of Smart City Initiatives

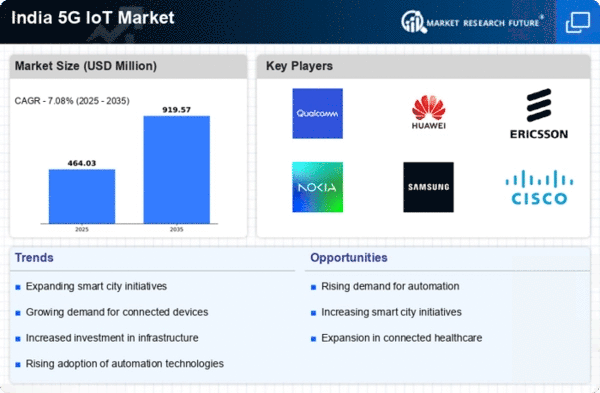

The 5G IoT Market is poised for growth due to the increasing number of smart city initiatives across India. The government has launched various projects aimed at developing smart infrastructure, which includes smart traffic management, waste management, and energy-efficient systems. These initiatives are expected to leverage IoT technologies, which require robust connectivity solutions provided by 5G networks. For instance, the Smart Cities Mission aims to develop 100 smart cities, with an investment of approximately $1.5 billion. This investment is likely to create a conducive environment for the 5g iot market, as it will facilitate the deployment of IoT devices and applications that enhance urban living. The integration of 5G technology into these smart city projects is anticipated to improve operational efficiency and provide better services to citizens, thereby driving the growth of the 5g iot market.

Rising Demand for Enhanced Connectivity

The 5G IoT Market in India is experiencing a surge in demand for enhanced connectivity solutions. As urbanization accelerates, the need for reliable and high-speed internet access becomes paramount. This demand is driven by the proliferation of smart devices and applications that require seamless connectivity. According to recent estimates, the number of connected devices in India is projected to reach over 1 billion by 2025, significantly boosting the 5g iot market. Enhanced connectivity not only facilitates better communication but also supports the development of smart cities, where IoT applications can thrive. The integration of 5G technology is expected to provide the necessary bandwidth and low latency required for real-time data processing, thereby transforming various sectors such as healthcare, transportation, and agriculture. This rising demand for enhanced connectivity is likely to propel the growth of the 5g iot market in India.

Emergence of Smart Agriculture Solutions

The 5G IoT Market is also benefiting from the emergence of smart agriculture solutions in India. With the agricultural sector facing challenges such as climate change and resource management, IoT technologies are being increasingly adopted to optimize farming practices. The integration of 5G technology enables farmers to utilize precision agriculture techniques, which rely on real-time data for decision-making. For instance, the use of sensors and drones can provide valuable insights into soil health, crop conditions, and weather patterns. It is estimated that the adoption of smart agriculture solutions could enhance crop yields by up to 20%, thereby improving food security. This trend is likely to drive the growth of the 5g iot market, as more farmers and agribusinesses seek to implement innovative solutions that enhance productivity and sustainability.

Rising Investment in Digital Infrastructure

The 5G IoT Market in India is witnessing a rise in investment in digital infrastructure, which is crucial for the deployment of 5G networks. The government and private sector are increasingly recognizing the importance of robust digital infrastructure to support the growing demand for IoT applications. Recent initiatives have seen investments exceeding $10 billion in enhancing telecommunications infrastructure, which is expected to facilitate the rollout of 5G technology. This investment is likely to create a favorable environment for the 5g iot market, as it will enable the development of advanced connectivity solutions necessary for various sectors, including healthcare, transportation, and smart cities. As digital infrastructure continues to improve, the potential for innovation and growth within the 5g iot market appears promising.