Emergence of Smart Cities

The development of smart cities in India is creating a substantial demand for the 5g industrial-iot market. As urbanization accelerates, cities are increasingly adopting IoT solutions to manage resources efficiently and improve the quality of life for residents. The Indian government has launched several smart city initiatives, with an investment of approximately $1.5 billion aimed at enhancing urban infrastructure. These initiatives often incorporate 5g technology to facilitate real-time monitoring and management of city services, such as traffic control, waste management, and energy distribution. The integration of 5g in smart city projects is expected to drive the growth of the 5g industrial-iot market, as it enables seamless connectivity and data exchange among various urban systems.

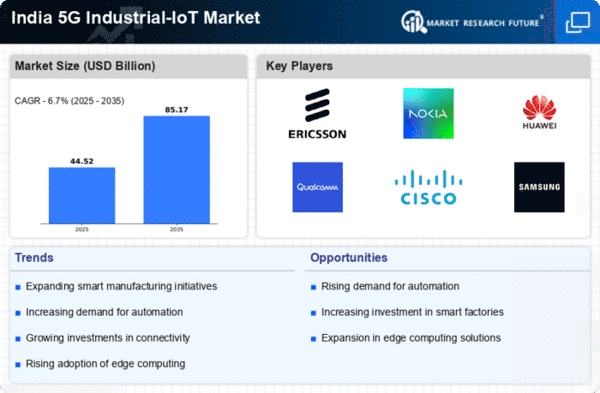

Rising Demand for Automation

The increasing demand for automation in various industries is a key driver for the 5g industrial-iot market. As companies strive to enhance operational efficiency and reduce costs, the integration of IoT devices and 5g connectivity becomes essential. Industries such as manufacturing, logistics, and agriculture are witnessing a shift towards automated processes, which require real-time data exchange and communication. According to industry estimates, the automation market in India is projected to grow at a CAGR of 15% over the next five years. This growth is likely to propel the adoption of 5g technologies, as they provide the necessary bandwidth and low latency required for effective automation, thereby significantly impacting the 5g industrial-iot market.

Increased Focus on Data Security

As the 5g industrial-iot market expands, the focus on data security is becoming increasingly critical. With the proliferation of connected devices, industries are recognizing the need to protect sensitive information from cyber threats. The Indian government has introduced stringent regulations to ensure data privacy and security, which is likely to influence the adoption of 5g technologies. Companies are investing in advanced security solutions to safeguard their IoT networks, which could potentially lead to a market growth of around 20% in cybersecurity solutions for IoT by 2026. This heightened emphasis on security is expected to bolster the 5g industrial-iot market, as businesses seek to implement secure and reliable IoT systems.

Government Initiatives and Policies

The Indian government has been actively promoting the adoption of advanced technologies, including the 5g industrial-iot market, through various initiatives and policies. Programs such as 'Digital India' and 'Make in India' aim to enhance the manufacturing sector's competitiveness by integrating cutting-edge technologies. The government has allocated substantial funding, estimated at over $1 billion, to support the development of 5g infrastructure. This financial backing is expected to facilitate the deployment of 5g networks across industrial sectors, thereby accelerating the growth of the 5g industrial-iot market. Furthermore, regulatory frameworks are being established to ensure seamless integration of IoT devices, which could potentially lead to a more robust industrial ecosystem in India.

Advancements in Industrial Applications

Technological advancements in industrial applications are driving the growth of the 5g industrial-iot market. Industries are increasingly leveraging IoT solutions for predictive maintenance, supply chain optimization, and real-time monitoring. The integration of 5g technology enhances these applications by providing faster data transmission and improved connectivity. For instance, the manufacturing sector is expected to see a 30% increase in productivity through the adoption of IoT and 5g technologies. This trend indicates a strong potential for growth in the 5g industrial-iot market, as businesses recognize the value of real-time data analytics and automation in enhancing operational efficiency.